The Ondo Finance (ONDO) token is trading at a critical historical support level after declining approximately 88% from its all-time high. According to an analyst, the demand zone between $0.20 and $0.30 could lead to a significant recovery if the price holds, with weekly closes above $0.20 being key. A failure to hold this zone could instead confirm a longer-term downtrend for the asset.

The Ondo Finance (ONDO) token is approaching a pivotal point following a significant decline. The asset is currently trading at $0.26705 with a market capitalization of $1.35 billion and a 24-hour trading volume of approximately $138 million.

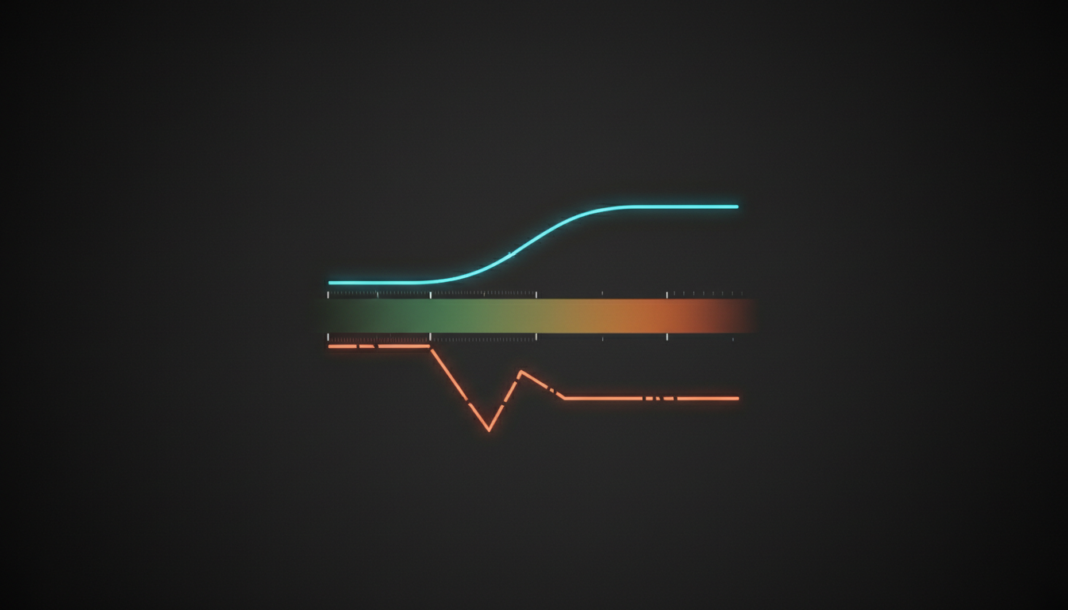

Analyst Crypto Patel pointed out that bearish divergence was first noted near the $2.14 macro top. The token has since broken down and tested a previous support level, now acting as resistance between $0.73 and $0.80.

The current weekly demand zone is identified between $0.20 and $0.30. Patel advises a cautious accumulation strategy while ONDO trades within this range.

Weekly closes above the $0.20 level are considered crucial for maintaining a broader bullish structure. Potential upside targets mentioned by the analyst are $0.70, $1, $2, and an extended $5 to $10 range.

The potential for a recovery is linked to real-world asset narratives that could drive adoption. However, a weekly close below $0.20 would negate the bullish structure and confirm the prevailing downtrend.