Memecoin PIPPIN has plunged more than 13% in the past 24 hours, deepening its monthly losses to approximately 36%. This decline significantly underperforms the broader, relatively flat cryptocurrency market. Data indicates that “smart money” investors sold over $675,000 worth of PIPPIN, contributing to widespread selling pressure among memecoins. Technical analysis shows the token’s price has broken its ascending trendline and remains choppy, trapped between key support and resistance levels, while liquidity clusters suggest a potential magnet for price movement toward $0.39.

The price of the memecoin PIPPIN crashed by over 13% in a single day, extending its monthly losses to about 36%. This underperformance occurred while the broader crypto market remained nearly flat over recent weeks.

Technically, the memecoin is undergoing a deeper correction evident on the charts. This decline is also reflected in on-chain activity data.

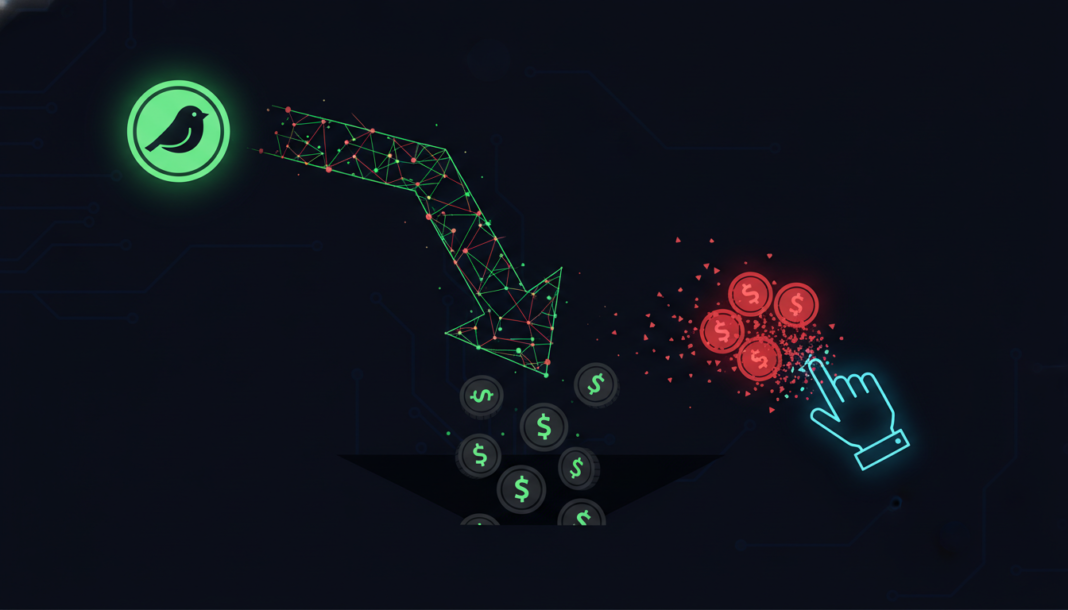

As per StalkChain data, PIPPIN was the most sold token in the last 24 hours. The so-called smart money offloaded more than $675,000 worth of PIPPIN during this period.

This capital withdrawal resulted in significant sell pressure that brought the memecoin’s price down. Other memes sold heavily in the same category included Fartcoin [FARTCOIN], WHITEWHALE, and PENGUIN.

The correction was market-wide for memecoins as traders moved from high-risk tokens to more stable assets. Inclusion of USDC in this list meant that traders were locking in profits or cutting their losses.

The PIPPIN price has been choppy since reaching a peak around $0.70. It broke below an ascending trendline, indicating a bearish trading structure.

Even minor price pumps between mid-December and now were insignificant. The price failed to break past its ongoing consolidation phase.

The Choppiness Index reading of 49 shows PIPPIN’s price is bouncing between $0.28 and $0.50. This follows a peak near 60, which indicated the price lacked a clear direction.

Historical data shows the price has previously bounced back after hitting the $0.29 support level. That pattern suggests a potential rise to $0.40 as a first target.

According to CoinGlass data, traders are now betting on the price, activating orders at the $0.39 level. Positions worth thousands of dollars are clustered between $0.39 and $0.42, acting as potential price magnets.

These liquidity clusters formed after the liquidation of long orders sitting below $0.36. That long squeeze accelerated the breakdown visible on the charts.

Choppiness on the charts, smart money selling, capital rotation, and a long squeeze all contributed to the crash. The price remains in a precarious technical position between key levels.