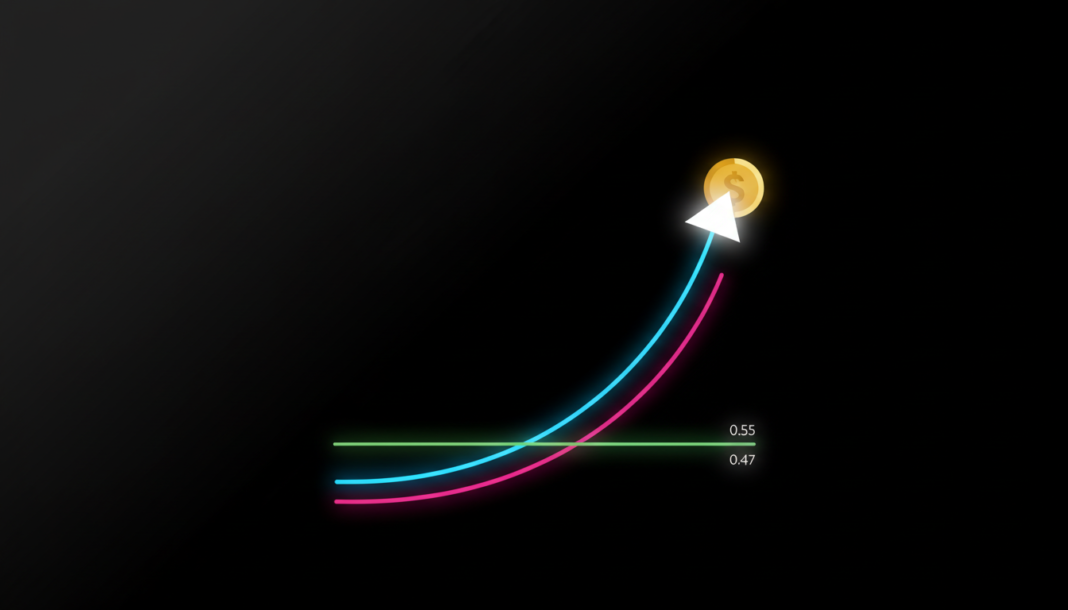

On January 28th, the memecoin Pippin [PIPPIN] rallied 69% despite a broader sector decline, with trading volume surging over 600%. Data from CoinGlass revealed two key liquidity clusters at $0.47 and $0.55 that would dictate near-term price action. Meanwhile, StalkChain reported it was the most-bought token by smart money that day, with over $120,000 in inflows.

The sharp rally in Pippin pushed it into a critical technical decision zone as momentum traders remained aggressive. Profit-taking risk increased significantly near key resistance levels.

A Liquidation Heatmap identified two critical price clusters at $0.55 and $0.47. A drop toward $0.47 would likely trigger long liquidations, accelerating downside pressure.

Conversely, holding above $0.55 could force short liquidations and fuel an upside squeeze. This setup left price action highly reactive to intraday sentiment shifts.

According to data from StalkChain, PIPPIN became the most-bought token by smart money in a single day. The inflows totaled $120,889.40, showing strong but potentially fleeting confidence.

Despite the surge, the concentrated smart money inflow was a double-edged sword. Large players piling in made the token a target for price manipulation, adding uncertainty.

At the time of reporting, the memecoin traded above the 50% Fibonacci Retracement, hovering near its $0.71 all-time high. The next upside target was aligned near $0.90, corresponding with the 79% Fibonacci level.

That potential move depended on clearing the $0.55–$0.56 resistance band. A clean breakout there could accelerate a run toward new highs.

However, failure to hold above $0.55 risked renewed liquidation pressure. A pullback toward $0.47 would likely invalidate the bullish setup.