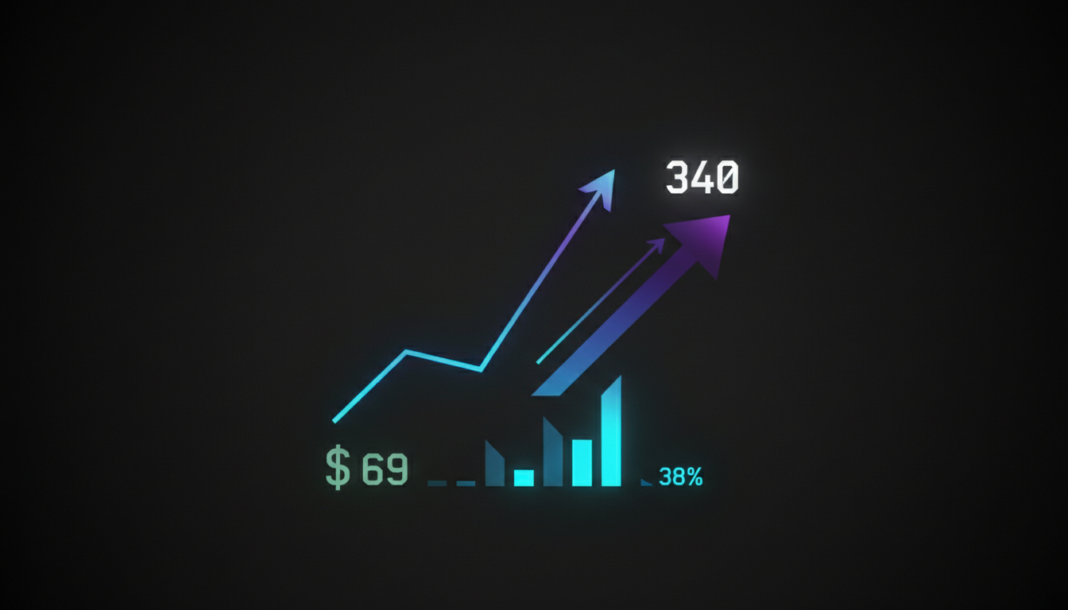

The cryptocurrency Quant (QNT) is trading at $69.16, holding above a crucial weekly support zone between $55 and $60. Its 24-hour trading volume increased 38% to $10.82 million while its market cap remained stable at $836.75 million. Analysts note the token is testing a multi-year symmetrical triangle pattern, with potential upside targets ranging from $100 to $340 if support continues to hold.

The cryptocurrency Quant (QNT) is holding firm at $69.16 as trading activity balances buying and selling pressure. Over the past 24 hours, the token’s volume climbed 38% to $10.82 million, with market capitalization stable at $836.75 million.

The token is testing a multi-year symmetrical triangle on the weekly chart while defending the key $55–$60 support zone. This ascending trendline has repeatedly prevented further declines, suggesting accumulation by traders.

According to the crypto analyst Jonathan Carter, if support holds, QNT could rotate higher within the triangle with initial targets at $100. A stronger upward move may reach $230, aligned with a major weekly supply zone, with full bullish expansion aiming for $340.

However, a weekly close below $55 would break the existing pattern and pose a threat of a decline toward the $45–$50 range. Analysts recommend monitoring for increased trading volumes and strong weekly closes to confirm an uptrend.

Technical indicators show bearish momentum may be easing. The Relative Strength Index (RSI) is at 41.09, indicating bearish pressure without an oversold signal.

The MACD line is below its signal line, confirming bearish momentum, but the shrinking histogram shows that selling pressure is easing. This contradictory signal could lead to a consolidation phase or a potential reversal.