Quant (QNT) may be signaling a bullish reversal, with an inverse head and shoulders pattern forming according to analyst Crypto Pulse. A confirmed breakout above $71 could validate the pattern and push the token toward the $80 range. Technical indicators show a neutral RSI at 56.47, while the MACD suggests short-term bullish momentum as the asset consolidates.

The cryptocurrency Quant (QNT) may be signaling a bullish turnaround, according to the crypto analyst Crypto Pulse, who identified a potential inverse head and shoulders pattern. This classic technical setup often indicates a shift from bearish to bullish momentum.

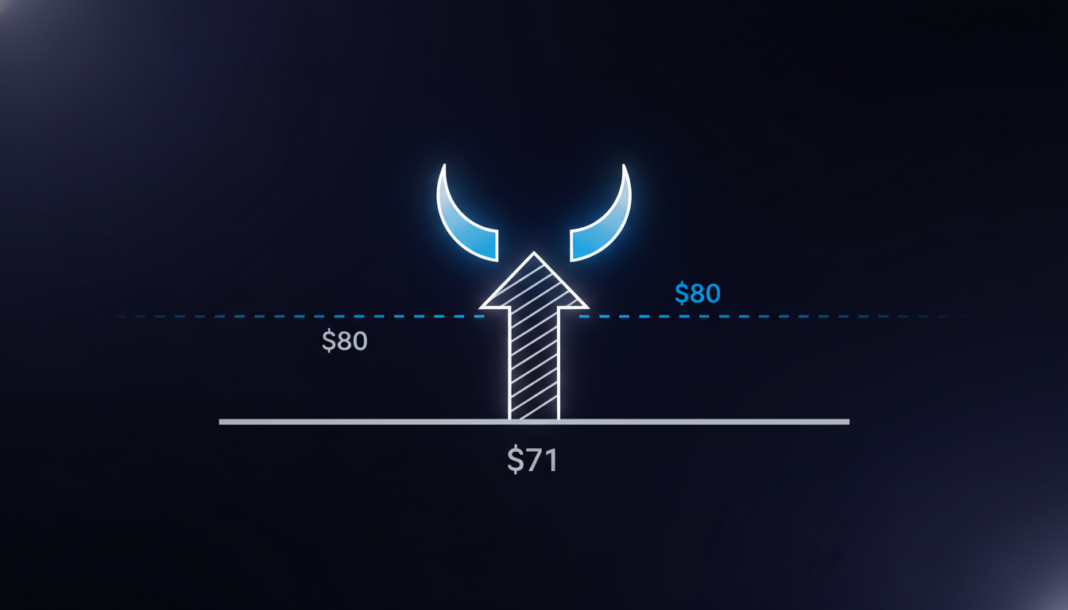

A breakout and close above $71 is necessary to validate the pattern, which could potentially lead to further increases. The momentum may allow QNT to retest highs in the $80+ region. On a 4-hour timeframe, QNT recently bounced back to the $68 area after a steep drop from $78 to $55 in early February.

The token is now crossing above its 20-day and 50-day simple moving averages but remains below its 100-day and 200-day averages. Bollinger Bands have tightened, indicating reduced volatility and a possible consolidation period. The Relative Strength Index (RSI) is at 56.47, suggesting neutral momentum.

The Moving Average Convergence Divergence (MACD) shows the signal line above, indicating short-term bullish movement. “The momentum may allow QNT to retest the highs in the $80+ region,” the analysis stated. Traders are watching closely for a confirmed breakout to mark a decisive shift in market sentiment.