Render (RENDER) opened 2026 with an 85% price surge in early January, significantly outpacing sector peers like Chainlink (LINK) and Bittensor (TAO). However, the rally has since faltered, with Open Interest declining nearly 30% and the price returning to its former $2 resistance zone, leaving its longer-term downtrend intact.

The cryptocurrency Render began January 2026 with substantial momentum, recording 85% growth in its first week. This performance far exceeded that of other artificial intelligence sector tokens, Chainlink and Bittensor.

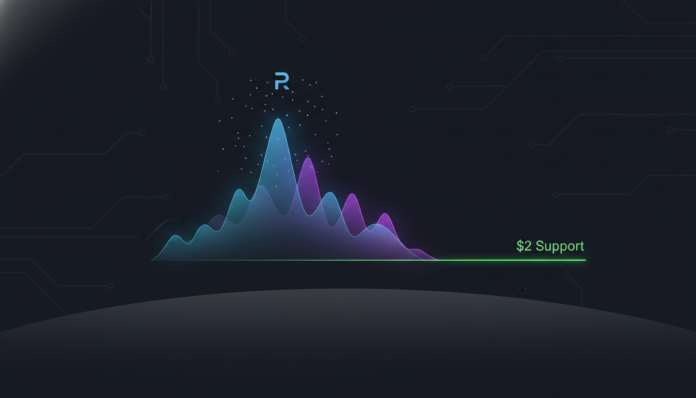

Market data from Coinalyze showed a nearly 30% drop in Open Interest following the initial surge. Despite a breakout above the key $2 level, the price has retraced back to that same demand area.

A recent comparison of on-chain metrics found Render did not measure favorably against the Artificial Superintelligence Alliance [FET] token. Furthermore, the token’s longer-term downtrend on price charts remained unbroken.

Technical indicators presented a mixed picture. The On-Balance Volume (OBV) hit a new high during the rally to $2.71, signaling buyer dominance, while the daily RSI stayed above 50.

However, the failure to break the November swing high of $2.94 confirmed the persisting bearish structure. This left bulls in a precarious position despite recent stability above the $2 mark.

Analysis of liquidity levels suggested potential for a short-term price dip. The cumulative short liquidation leverage near the $1.86-$1.88 zone could draw prices downward.

This area aligns with a higher-timeframe supply zone from November, spanning $1.68 to $1.86. “Traders can wait for a sweep of this region before looking to buy Render tokens,” the analysis concluded.

It noted that cumulative long liquidation leverage above $2.15 could then attract prices higher again. The overall assessment anticipated a dip below $2 followed by a potential rebound.