The Sandbox (SAND) cryptocurrency is testing a critical technical pattern that analysts suggest could precede a significant price move. According to an analysis, SAND is positioned at the lower boundary of a falling wedge on its weekly chart, a pattern often associated with bullish reversals. Supporting this view, the Relative Strength Index shows bullish divergence, indicating weakening selling pressure. A confirmed breakout from this pattern could, as stated, target price levels up to $2.65.

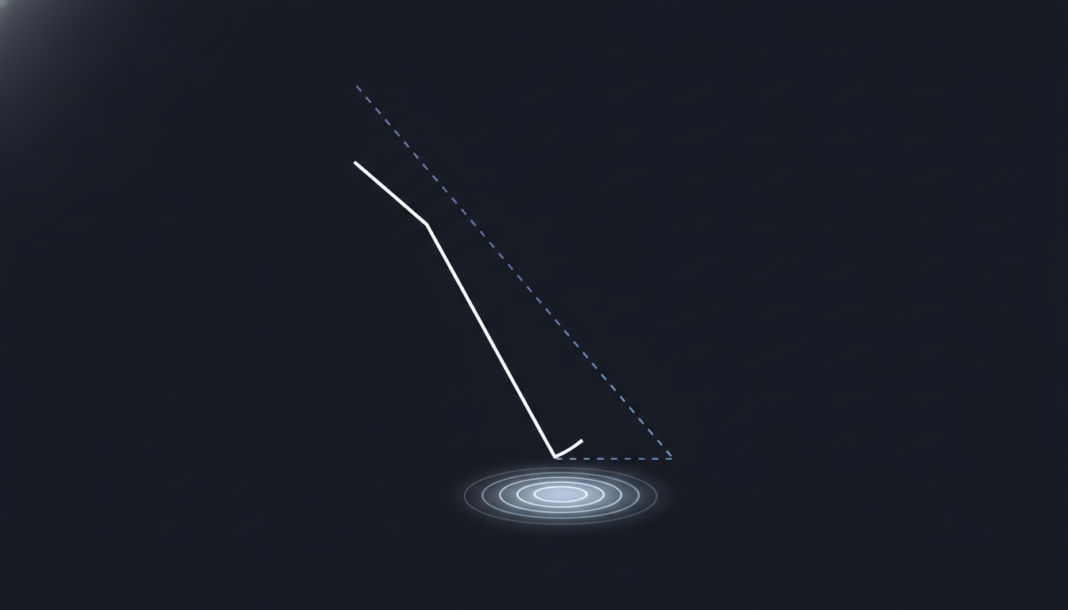

The native token of the metaverse platform The Sandbox is testing a key technical formation. On Thursday, February 12, SAND was observed testing the lower boundary of a falling wedge pattern on its weekly timeframe.

This activity signals a potential shift in market momentum. “According to the crypto analyst Jonathan Carter, the price has managed to stay above crucial support,” which is vital for determining future direction. Accompanying this price action, bullish divergence has appeared on momentum indicators like the RSI. This occurs when the price makes lower lows while momentum improves, suggesting sellers are losing strength.

The falling wedge itself represents a period of consolidation that typically concludes with an upside breakout. Analysts note that a successful breakout could see the price advance toward several specified targets. These projected levels include $0.13, $0.22, $0.40, $0.90, $1.45, and ultimately $2.65.

Current technical readings present a mixed picture for short-term momentum. As of the same date, SAND was trading below its 20-period simple moving average, indicating bearish near-term pressure. However, the narrowing space between the MACD line and its signal line suggests decreasing bearish strength, which could support a reversal if resistance is broken.