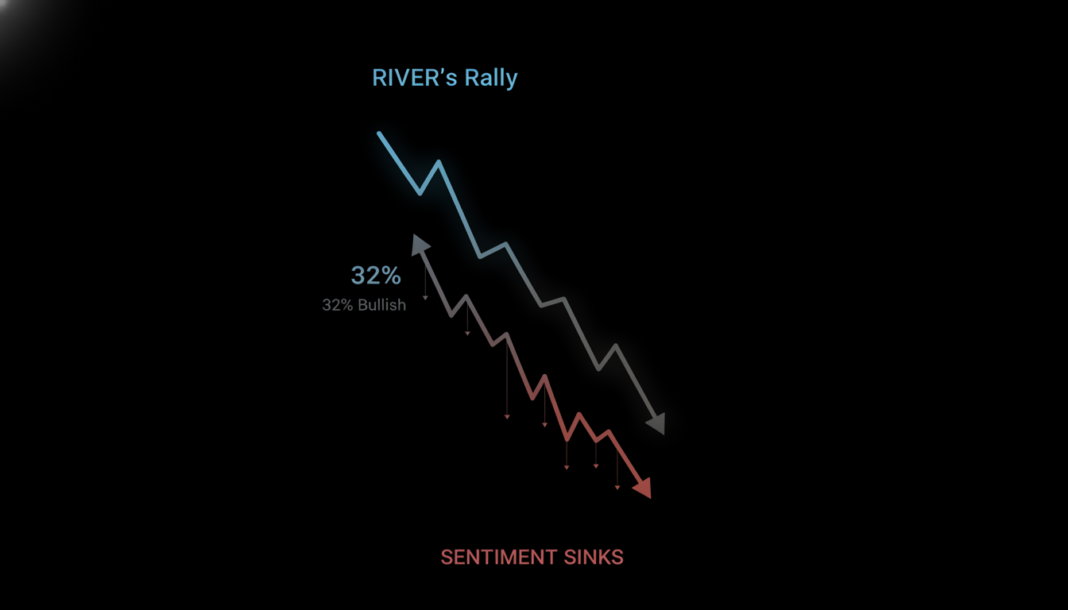

The cryptocurrency River [RIVER] has seen nearly half of its recent 200% rally erased amid a decisive shift to bearish sentiment. Community sentiment has dropped sharply to around 32%, with bears now in firm control as capital exits the market. Technical indicators align with the pressure, signaling a continued downtrend for the asset’s near-term trajectory.

The cryptocurrency River [RIVER] has surrendered nearly half of its earlier 200% rally, reinforcing the impact of a recent sell-off. Beyond profit-taking, specific catalysts appear to be driving the decline as market consensus shifts decisively to the downside.

Investor positioning has turned clearly bearish, according to Community Sentiment data. At press time, sentiment stood at roughly 32%, with only 2,656 of roughly 8,300 voters remaining bullish.

This shift is also visible in on-chain data, where the number of holding wallets has dipped slightly. The movement carries weight as approximately 88.09% of RIVER’s supply is held by the top ten wallets, suggesting large holders may be reducing exposure.

Liquidity outflows have accelerated, with Open Interest declining by roughly 5%. About $7.75 million has exited the market, pushing total OI down to $136.61 million.

Funding Rate data further clarifies the nature of this move, having slipped into negative territory at -0.0059%. This signals that short positions now outweigh long positions, and persisting outflows could lead to another significant price decline.

Technical indicators offer little relief, with the Moving Average Convergence Divergence (MACD) remaining firmly negative. The Parabolic SAR continued to flash bearish signals, with a consistent formation of dots above price action.

Overall, signals across sentiment, liquidity, and technical metrics continue to converge on a bearish outlook. These factors are likely to play a decisive role in shaping RIVER’s near-term price trajectory.