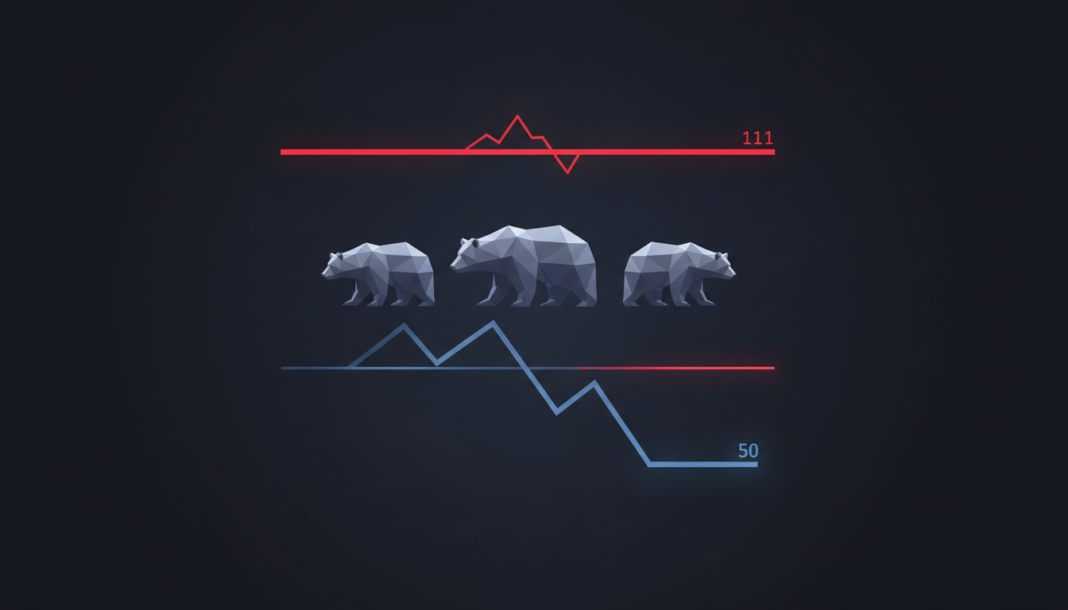

Solana (SOL) is trading under significant technical pressure, currently priced near $82. This places it below major moving averages, confirming a bearish market structure. The $111 level is now a critical resistance point following a recent breakdown. Analysts identify $74.11 and $50.18 as the next key support levels to watch for a potential stabilization or further decline.

Solana is in a correction period after experiencing multiple months of selling pressure. The coin was trading at approximately $82.10 at the time of reporting.

Data from TradingView shows SOL has been unable to reclaim the $111 horizontal price level. The formation of continuous lower highs and lower lows confirms the prevailing downtrend.

The 50-day moving average is declining near $114, remaining far below the 200-day average of $161. This alignment suggests a significantly weaker long-term structure for the asset.

Momentum indicators show buyers are not exerting much strength to the upside. The MACD’s most recent period of recovery remained below the zero line, indicating insufficient buying pressure.

A breakdown below $74.11 is expected to trigger increased selling activity. This would target the $50.18 level, a defined point of interest during Solana’s past consolidation phases.

A crypto analyst recently assessed SOL’s key levels. He has identified $74.11 and $50.18 as providing both critical resistance and support levels, of which, if protected, will allow SOL to stabilize; if not protected, will lead to continued selling within the market.

In summary, Solana faces technical weakness below the $111 resistance area. The market’s reaction around the $74 support zone will likely determine the next significant price direction.