Solana (SOL) faces significant bearish pressure, breaking a key $118 support level held since March 2024. A whale’s massive short position and institutional ETF outflows underscore the negative sentiment, with technical analysis suggesting a potential 30% decline toward $78 if the price remains below $118.

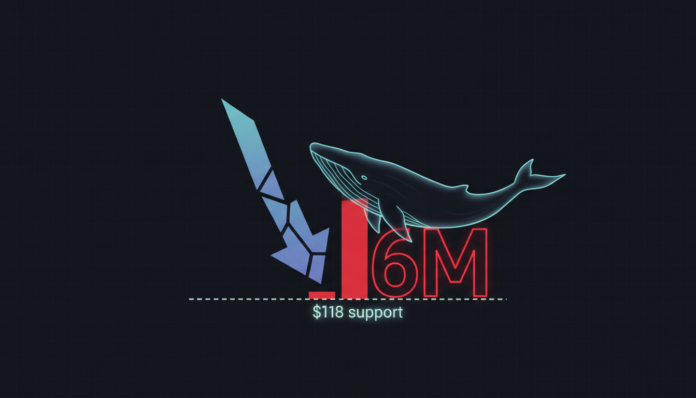

The crypto market faced a slump, intensifying selling pressure on Solana [SOL] as sentiment turned bearish. Within this sell-off, SOL lost its $118 support level defended since March 2024. According to the crypto tracker Onchain Lens, a newly created wallet deposited $2 million USDC on the Hyperliquid DEX and opened multiple short positions. This included a massive SOL short position worth $6.15 million.

U.S.-based Solana spot exchange-traded funds (ETFs) recorded a significant outflow of $2.22 million according to on-chain analytics platform SoSoValue. This suggests investors and institutions are withdrawing capital from the underlying asset. Both developments highlight the negative market sentiment toward Solana.

At press time, SOL plunged 6.65% over 24 hours and was trading near $115. Despite the price decline, SOL’s trading volume jumped 105% to $7.60 billion, indicating heavy market participation. On the weekly chart, the asset had previously rebounded from the $118 support more than ten times but has now failed to hold it.

Price action suggests SOL could see a strong downside move, potentially declining by 30% to the $78 level. However, this outlook would only be validated if the asset remains below the $118 level. Technical indicators, including the 50-day Exponential Moving Average (EMA) and the Average Directional Index (ADX), support SOL’s bearish outlook. SOL was trading below the 50 EMA, while the ADX rose to 33, suggesting a strong directional trend.

From a derivatives perspective, traders appear strongly positioned on the bearish side. According to CoinGlass data, intraday traders are closely monitoring two critical price levels: $112.8 on the downside and $120.2 on the upside. Short-leveraged positions total $55.15 million, while long-leveraged positions are far larger at $241 million. This positioning highlights the market’s current tension.