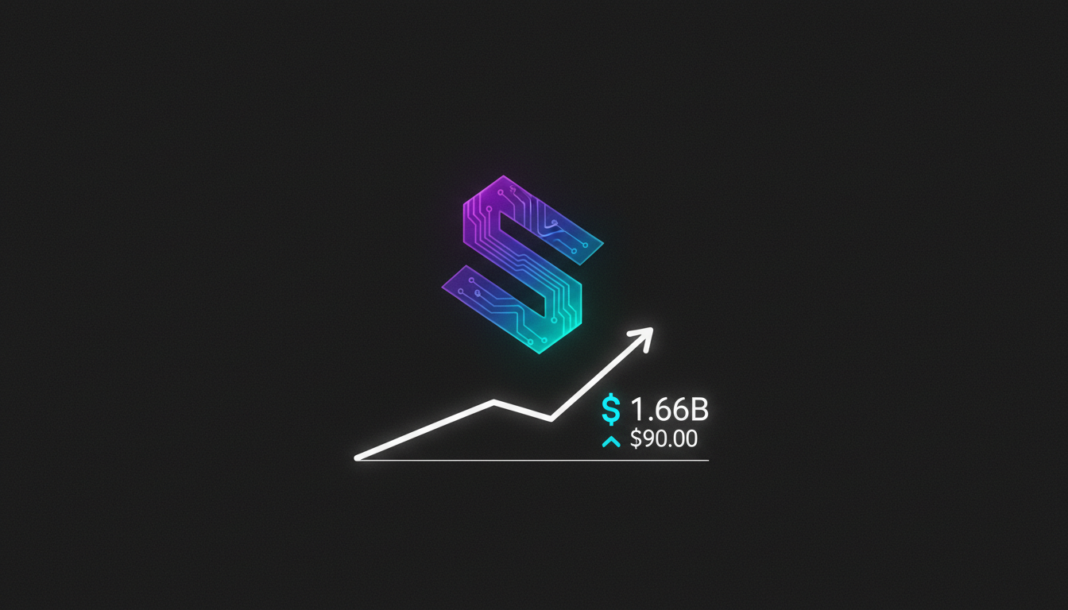

Solana’s ecosystem for tokenizing real-world assets (RWA) reached a new all-time high of $1.66 billion on February 15. The network’s native token, SOL, was simultaneously testing a critical $90 resistance level, needing a confirmed four-hour candle close above it to sustain bullish momentum. Technical indicators suggested an ongoing recovery from an early-February sell-off.

Solana’s RWA ecosystem reached a new all-time high on Sunday, February 15, surpassing $1.66 billion in tokenized assets. This milestone reflects increasing use of the blockchain for accessing treasuries, private credit, and other traditional assets.

The surge underscores growing confidence in blockchain infrastructure for global asset settlement. It also strengthens Solana‘s position in the competitive race to modernize financial markets through expanding DeFi integrations.

Concurrently, Solana (SOL) was pushing against the crucial $90 resistance level. The crypto analyst Crypto Pulse notes that “a bullish breakout in the token would require a four-hour candle close above the $90 level.”

Without such a close, analysts identified the first potential support area near $82.5. A continued bearish trend could see SOL fall back to the $77 area, where aggressive buying was previously observed.

As of February 15, SOL was trading at $90, having recovered from an early February drop to around $74. Momentum indicators supported the idea of ongoing price recovery at that time.

The RSI (14) was noted at 70, reflecting high buying activity but also warning of a potential short-term drop. The MACD showed a bullish crossover with expanding green bars, confirming upside momentum.