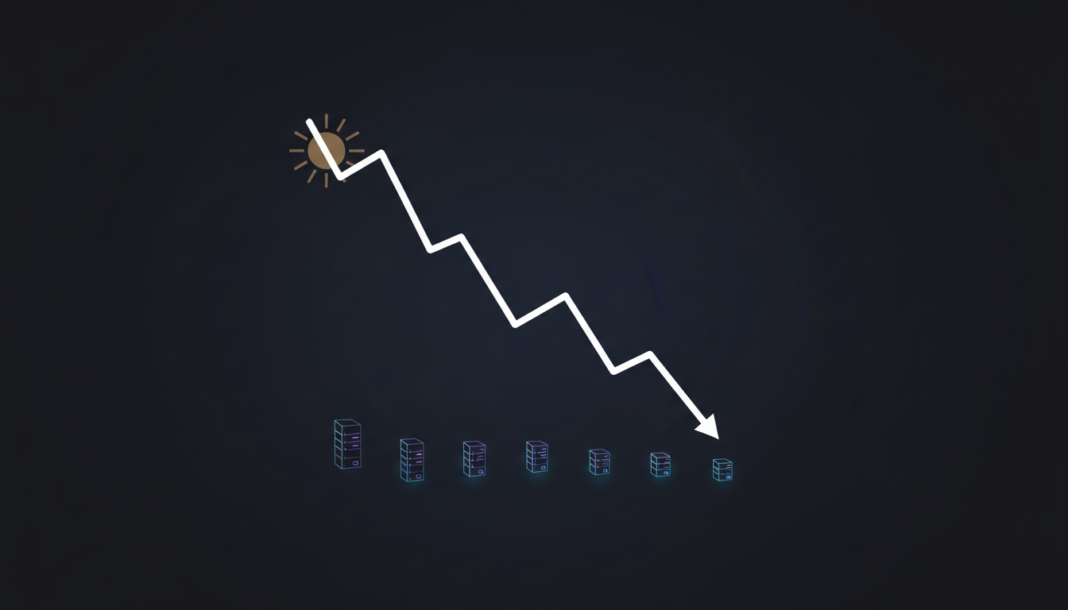

Solana’s validator count has fallen to a multi-year low of 789, down nearly 43% since 2025. Analysts note this decline coincides with a weakening price, raising concerns about network revenue pressure. While total network fees have grown by approximately 150% to $1.23 million, monthly transactions have declined, indicating the fee increase is cost-driven rather than a sign of broader usage growth.

Recent market volatility has pushed major cryptocurrencies below key support levels. Analysts aren’t expecting an altcoin rally soon, as capital rotation remains muted.

This puts Solana’s technical support under pressure. The situation is compounded by a significant drop in the network’s operational backbone.

Data from TheBlock shows Solana’s daily validators have fallen to 789. This marks the lowest level since late December 2024 and a drop of nearly 43% since 2025.

A similar pattern occurred during the previous bear cycle. At that time, Solana’s price fell 30% in a month as validators plunged 51%.

This alignment suggests pressure beyond just market sentiment. When validator exits coincide with price drops, it strains the network’s operational economics.

Network fees have risen roughly 150% to $1.23 million this cycle. However, monthly transactions are sliding, down from over 2 billion in December.

This divergence signals fee growth is driven more by higher costs than increased usage. The setup does not provide a stable revenue base for validators.

With weak technicals and cooling market interest, the risk of further validator exits persists. This could repeat patterns observed during the 2024 bear cycle.