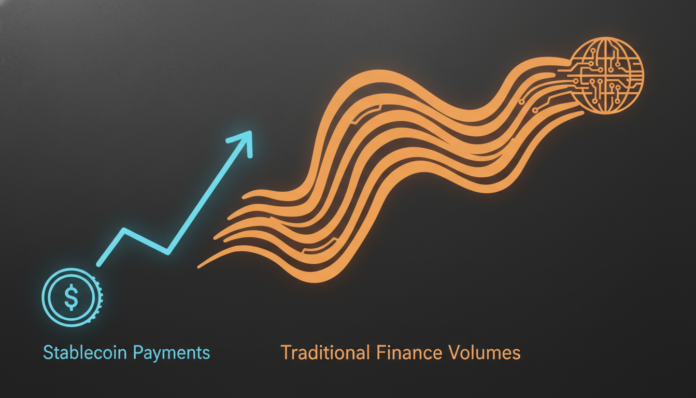

Stablecoin payments reached $390 billion in 2025, yet this constitutes less than 1% of the $2 quadrillion global payment volume, according to a joint report. While explosive growth is seen in business-to-business and card-linked spending, the vast majority of stablecoin volume remains tied to crypto trading and internal transfers, not real-world commerce.

A recent report detailed that stablecoin supply has grown 76x since 2020, surpassing $300 billion. However, these “on-chain dollars” accounted for less than 1% of global annual payment volumes, which totaled $2 quadrillion in 2025.

Within the $35 trillion total stablecoin volume last year, real-world payments like remittances and payroll comprised just $390 billion. The remaining 99% was linked to crypto trading, speculation, and other non-payment activities.

Business-to-business (B2B) stablecoin payments were the top driver, climbing to $226 billion for a 733% growth rate year-on-year. Card-related spending in stablecoins also exploded by 673% in 2025, marking these two sectors for significant opportunity.

Peer-to-peer payments ranked second at $77 billion, followed by consumer-to-business transactions at $76 billion. Business-to-consumer activities, such as payroll, were a distant last at only $10 billion.

The stablecoin supply grew by over $100 billion in the past year to reach $307 billion. Nearly half of this new growth was driven by Tether’s USDT, which increased by $48 billion to $186 billion.

Circle’s USDC increased by $26 billion to $76 billion, while Sky Protocol’s USDS, PayPal’s PYUSD, and World Liberty Financial’s USD1 rounded out the top five. The report noted that 99% of stablecoins remain denominated in U.S. dollars.

The analysis concluded that “strong stablecoin payment traction could surpass legacy transfers in less than a decade due to cost and speed benefits.” This $390 billion figure differs from Visa’s reported $11 trillion in stablecoin transaction volume.