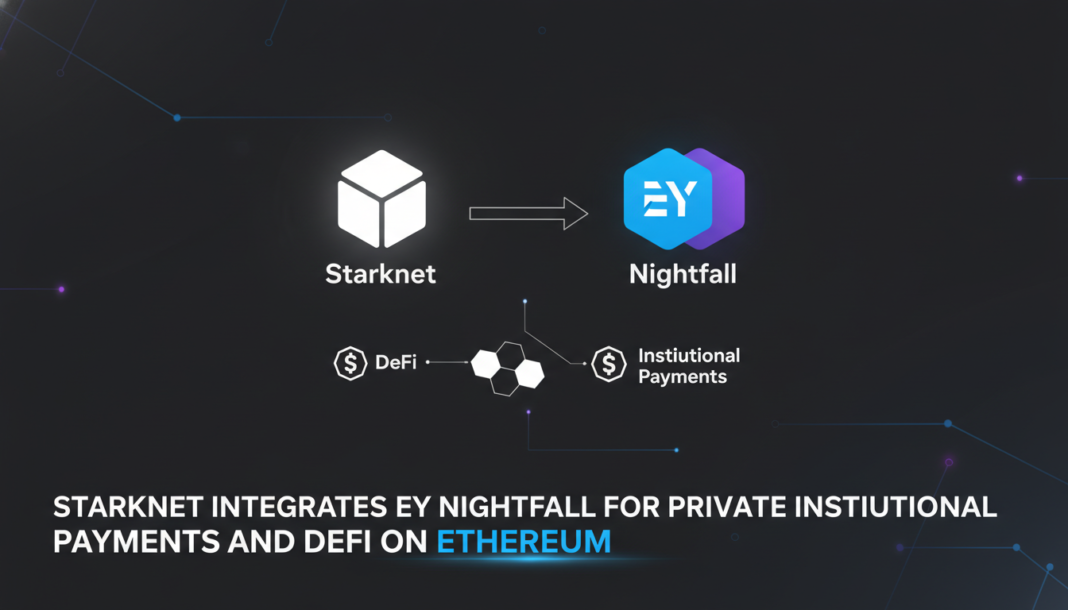

Starknet developer StarkWare has integrated EY‘s Nightfall privacy protocol, aiming to attract banks and corporations to public blockchain rails. The integration enables private payments, confidential DeFi activity, and tokenized asset transfers on Ethereum-aligned layer-2 Starknet. The move is positioned as offering institutions the auditability and compliance features they require without sacrificing transactional privacy.

StarkWare has integrated EY‘s open-source Nightfall protocol onto the Starknet network. This allows institutions to conduct private business-to-business payments and confidential treasury management on a public layer-2.

The system uses zero-knowledge technology to verify transactions without revealing underlying data. Institutions can also access Ethereum DeFi for lending and swaps with privacy by default but supporting auditability.

StarkWare frames this as a breakthrough for institutional capital, which has been deterred by full blockchain transparency. Co-founder Eli Ben-Sasson said blockchains could give every institution “the equivalent of a private superhighway for stablecoins and tokenized deposits.”

Alex Gruell, StarkWare’s global head of business development, stated Nightfall is useful for institutions requiring ready-to-go KYC verification. He said the EY-built system adds a layer of institutional credibility and “regulatory fluency.”

Gruell contrasted the model with “siloed” institutional environments on rival networks and permissioned models like Canton Network. He stressed Nightfall will remain permissionless and fully integrated into Starknet, with a staged rollout.

Starknet has grown to hold about $280 million in total value locked, according to data. Its usage is primarily driven by DeFi protocols and native ecosystem applications.

The network has faced reliability challenges, including major outages in 2025 linked to sequencer issues. This prompted public commitments to harden its systems before attracting more institutional activity.