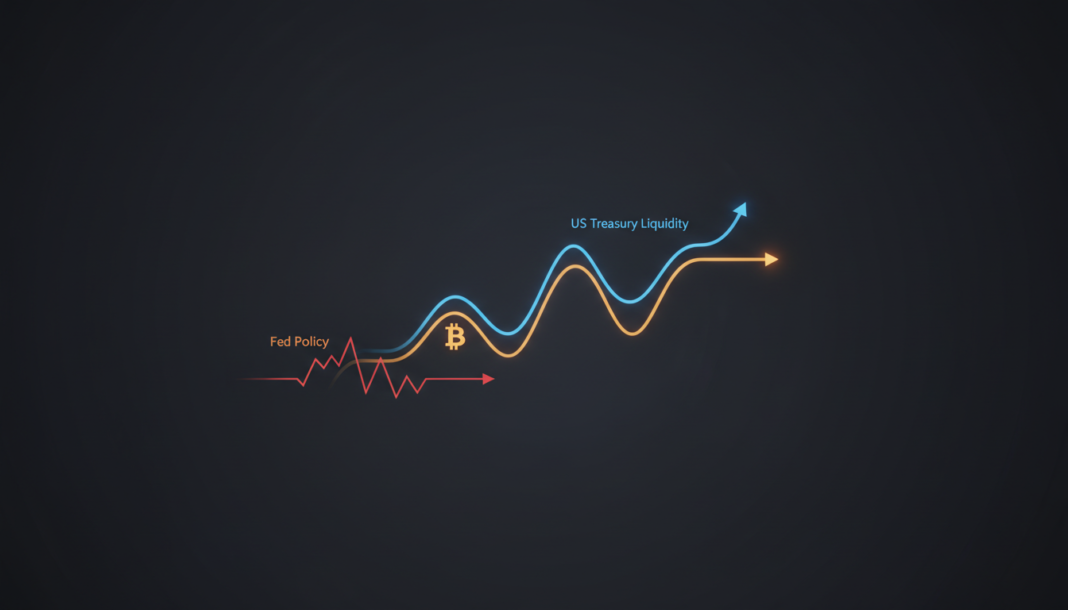

A new analysis suggests U.S. fiscal policy, not Federal Reserve actions, is the primary driver of Bitcoin’s price cycles. The report finds an 80% correlation between U.S. Treasury bill issuance and Bitcoin’s price trend since 2021, with liquidity shifts leading price changes by about eight months. It notes that a 1% change in global liquidity historically moves Bitcoin by about 7.6% the following quarter and identifies the upcoming $38 trillion debt rollover cycle as a potential future liquidity catalyst.

A recent report indicates U.S. Treasury Bill issuance, rather than Federal Reserve policy, is the primary driver of Bitcoin’s price cycles. The analysis states fiscal liquidity is a more effective indicator for Bitcoin performance than interest rates or central bank asset expansion.

The report reveals an 80% correlation between net T-Bill issuance since 2021 and Bitcoin’s price action. It notes liquidity shifts typically occur approximately eight months before price changes.

At the time of the report, Bitcoin traded near $66,000 as macro liquidity tightened. The Treasury Department funds the private sector through government spending before money flows into financial markets.

Therefore, Treasury funding represents a lagging yet more predictable indicator for Bitcoin’s direction than Federal Reserve actions. The report suggests that Treasury issuance is emerging as a more important macro signal than Federal Reserve policy.

Keyrock’s analysis reveals that each 1% change in global liquidity leads to an approximate 7.6% move in Bitcoin within the following quarter. Increased T-Bill issuance leads to rising demand for Bitcoin, while decreased issuance often precedes multi-month price declines.

This challenges the prevailing notion that interest rate changes are the dominant macro trigger for cryptocurrency market cycles. The report also states institutional inflows have reduced Bitcoin’s sensitivity to macroeconomic factors by approximately 23%.

Keyrock indicated the upcoming U.S. debt rollover cycle may serve as a future catalyst for increased liquidity. Approximately $38 trillion of national debt is expected to be rolled over in the next four years.

The Treasury will need to issue significantly more short-term T-Bills to fund an estimated $600-$800 billion in annual debt refinancing requirements until 2028. This new T-Bill issuance cycle could result in additional liquidity entering the markets, potentially impacting Bitcoin’s price in late 2026 or early 2027.