President Trump has framed his forthcoming Federal Reserve Chair nomination as a key catalyst for market liquidity and, by extension, Bitcoin’s price. He has publicly advocated for more interest rate cuts. However, recent economic data, including an elevated Producer Price Index reading, challenges the narrative that such easing is imminent. Meanwhile, Bitcoin has retreated to a two-month low near $80,000, with on-chain data suggesting investor capitulation amid persistent market volatility.

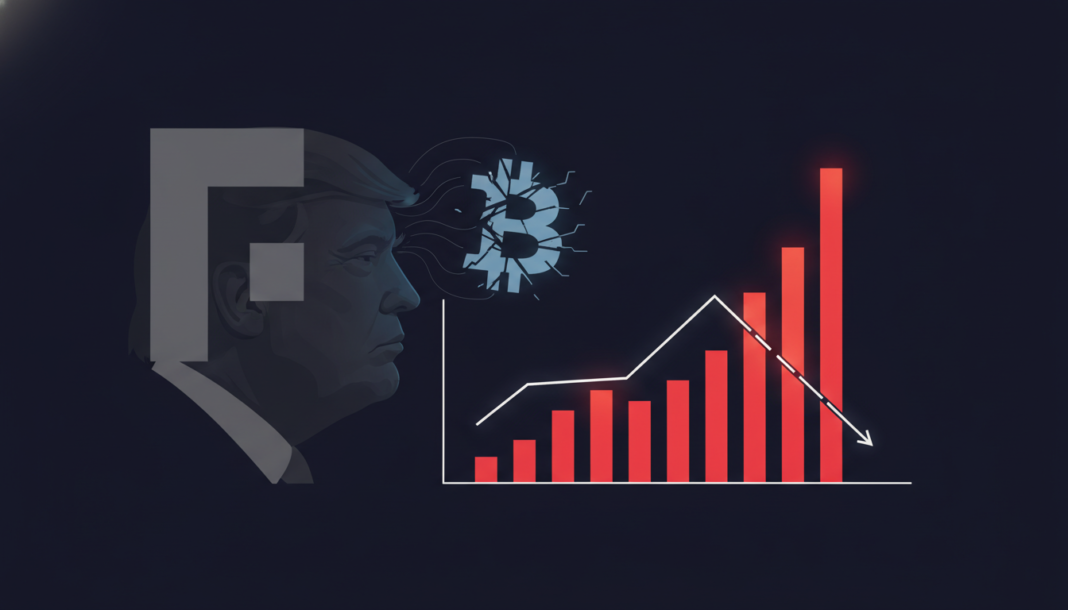

President Trump has positioned his upcoming Federal Reserve Chair selection as a significant market catalyst, directly linking it to liquidity expectations. He has been pushing for further interest rate cuts, insisting they would come *“without any pressure.”*

This push fits a historical pattern where Bitcoin has rallied during monetary easing cycles. Despite this, Bitcoin recently declined to a two-month low around $80,000 amidst broader market uncertainty.

Inflation data continues to complicate the rate cut narrative. The December Producer Price Index came in at 3%, higher than the anticipated 2.7%. This signals persistent inflationary pressures that could delay any Fed policy easing.

Market volatility has been a dominant force, overshadowing regulatory progress. Over the past fifteen months of President Trump’s term, most major cryptocurrencies have seen double-digit declines, with Aptos dropping over 80%.

On-chain metrics reflect this pressure, showing cohorts of investors capitulating and moving Bitcoin to exchanges. This activity occurs even as hopes for rate cuts persist, highlighting a disconnect between policy narratives and market behavior.

The gap between the theoretical benefits of a dovish Fed and on-the-ground market reality appears to be widening. While regulatory frameworks aim to bolster Bitcoin’s status, macro volatility continues to shake investor confidence and blunt the potential impact of monetary policy.