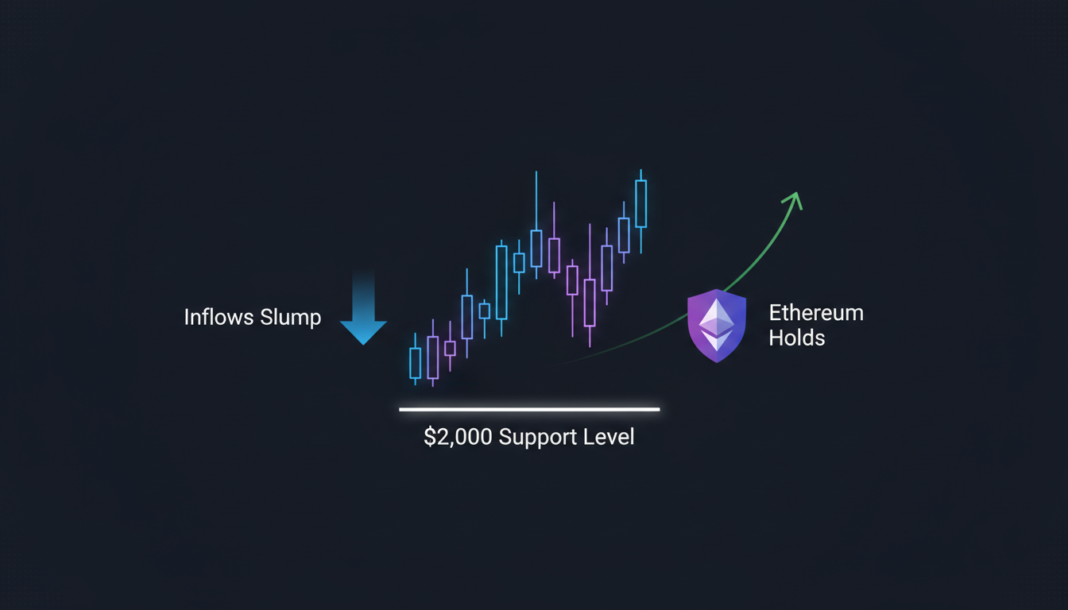

Ethereum has struggled to maintain momentum, trading near $2,000 for the first time since a previous 60-day consolidation period in early 2025. Analysis indicates the asset is in a market “cool-down” phase, a condition historically linked to potential rebounds, but weak institutional and spot demand suggests a decisive recovery is not yet imminent.

Ethereum’s price revisited the $2,000 trading zone, marking its first return to this range since a similar period from March to May 2025. The move is tied to a broader market structure lacking conviction, with the possibility of further drawdown still present.

Recent analysis suggests ETH is undergoing a historical cool-down phase measured by a composite Market Temperature metric. As of reporting, this metric sat slightly above zero, indicating the cooling may not be complete before a sustainable recovery emerges.

On the social platform X, the analyst Alphractal stated these zones reflect periods where “unrealized profits are reduced, valuation becomes more balanced, and emotional excess fades from the market.” Historically, such conditions have acted as growth catalysts, but markets often require time to rebuild conviction before a rally materializes.

Demand remains clearly subdued, increasing the likelihood ETH continues trading near the lower end of its range. U.S. Spot Ethereum exchange-traded funds recorded one of their weakest inflow days since inception, with just $10.26 million worth of ETH absorbed according to SoSoValue.

The positive inflow is mildly constructive, but the magnitude confirms fragile bullish conviction. The two trading sessions preceding this reading recorded a combined $242.2 million in outflows.

Spot market activity mirrors this institutional weakness, with recent net purchases partially offset by selling pressure in the prior session. The persistent lack of strong buying interest continues to weigh on price action, limiting Ethereum’s ability to capitalize on its structural cool-down phase.

While exchange reserves have declined, which theoretically supports bullish setups by limiting sell-side liquidity, supply contraction alone cannot sustain a rally. Without stronger demand and improving sentiment, price expansion remains constrained.

For a sustained bullish trajectory, stronger demand inflows, improving sentiment, and renewed institutional participation must align with the cool-down phase. Until those elements converge, ETH may remain range-bound or vulnerable to further downside.