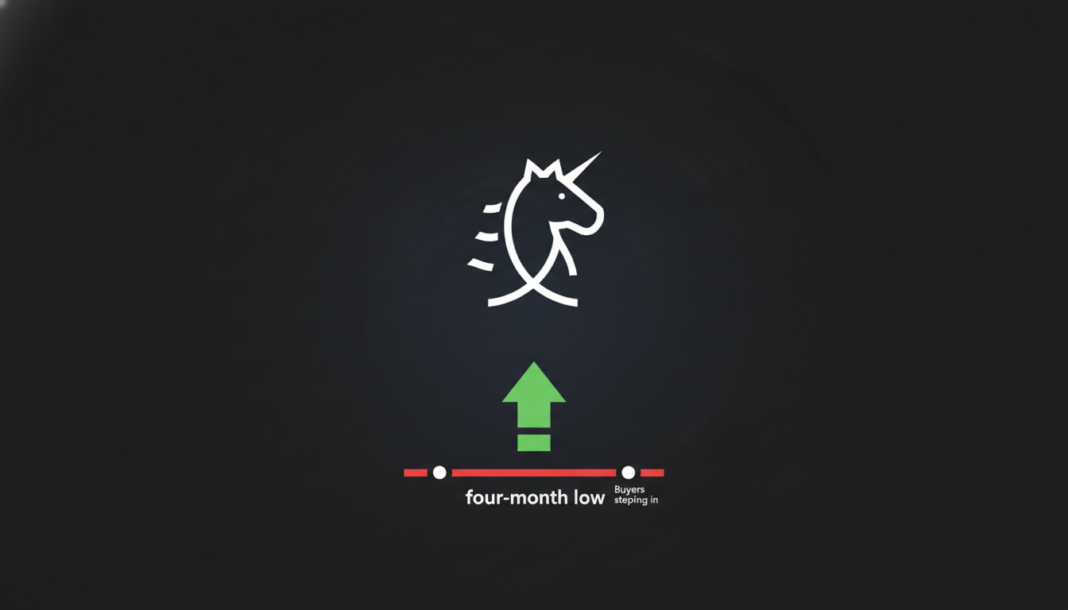

Uniswap’s UNI token staged a significant recovery, rebounding from a four-month low below $3 to trade near $3.50. The rally was driven by strong buyer interest, as evidenced by substantial exchange outflows, but technical indicators suggest sellers maintain control, leaving the token’s near-term direction uncertain.

With the broader market recovering, Uniswap’s [UNI] token showed bullish momentum. It staged a strong comeback after slipping to a four-month low of $2.80, successfully defending the $3 level and reaching a high of $3.50.

At the time of writing, UNI traded at $3.49, up 9.2% on the daily charts. Over the same period, the market capitalization rebounded above $2 billion.

Investors entered the market with conviction after UNI breached $3, attempting to avoid further declines. This sentiment was overwhelmingly prevalent in the spot market, where buyers rushed to scoop up a discount.

CryptoQuant data showed that Uniswap recorded 3.8 million UNI in exchange outflows on the 6th of February. Between the 6th and 7th of February, Uniswap saw -$6.5 million in spot netflow, confirming higher outflows.

The Buyer vs. Seller Strength Indicator on TradingView confirmed this market trend. Buyer strength skyrocketed to 89 before falling to 29 at press time.

The surge in buyer strength drove the market to recover from recent losses. At the same time, seller strength was elevated to 70 as dip buyers cashed out.

These market conditions showed fierce competition for market control. For now, while buyers have shown strength, sellers remain active.

The downside momentum remains intact as evidenced by momentum indicators. The altcoin’s Directional Movement Index fell to extreme oversold levels, while its negative index rose significantly.

A rising ADX while +DI declines indicates strong downside momentum, with sellers in control. Therefore, recent buyers’ attempts have proven inadequate to sustain a trend reversal.

As such, these conditions point towards the continuation of the prevailing trend. For a reversal, buyers must push the daily close above the EMA20 at $4.20.