Amid a broader market sell-off, Hyperliquid‘s HYPE token has gained roughly 14% in 2026, making it a rare altcoin finishing the quarter in the green. However, the token has faced two failed attempts to break the $30 resistance level, creating a volatile setup that analysts view as a potential bull or bear trap. Whale positioning remains predominantly bearish, anticipating another rejection, while strong on-chain activity and recent institutional accumulation suggest underlying strength.

In a market environment characterized by broad sell-offs, assets that diverge from the trend can spark momentum-driven frenzies. Hyperliquid’s HYPE token has done exactly that, posting approximately 14% gains so far in 2026.

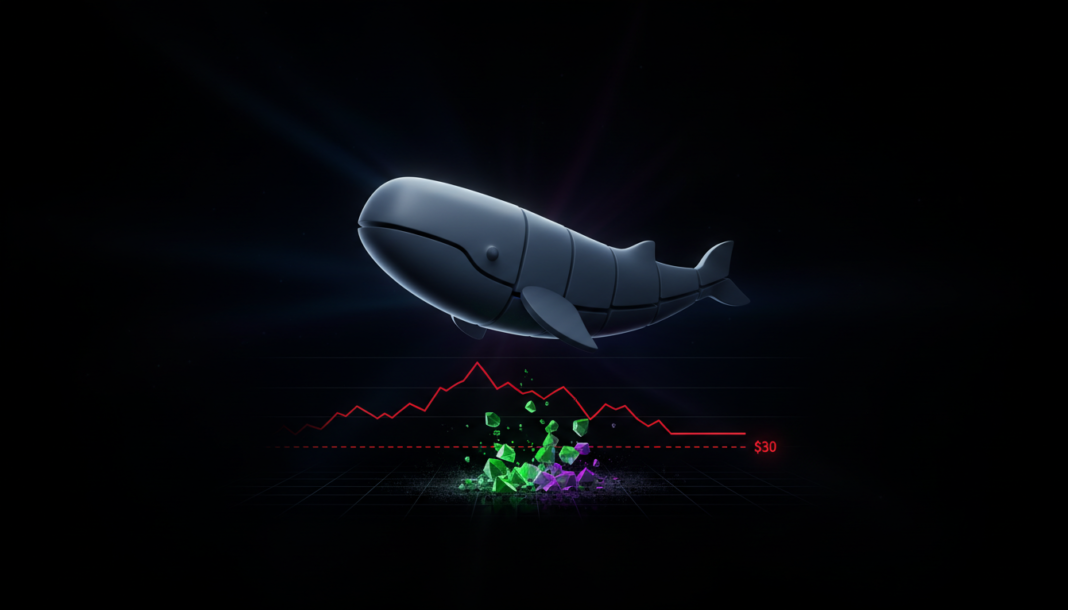

The $30 price level has proven to be a tough ceiling, with two failed breakout attempts placing HYPE in a classic volatility loop. The largest cohort of whales appears to expect another rejection, with speculative bets still skewed to the downside.

Following a brief run past $38, the token has pulled back nearly 12% over two weeks to the $28 level. Analysts see this more as a short-term reset than a breakdown in fundamentals, as on-chain activity remains strong.

Substantial investor confidence is evident from major holders like Arthur Hayes, co-founder of BitMEX. Arkham Intelligence data shows Hayes recently added another 1 million HYPE, bringing his total holdings to 6.4 million tokens.

This activity contributes to a growing trend of institutional accumulation behind the token. With fundamentals described as solid and 31% of protocol volume coming from real-world assets like stocks and commodities, the stage is set for a potential short squeeze.