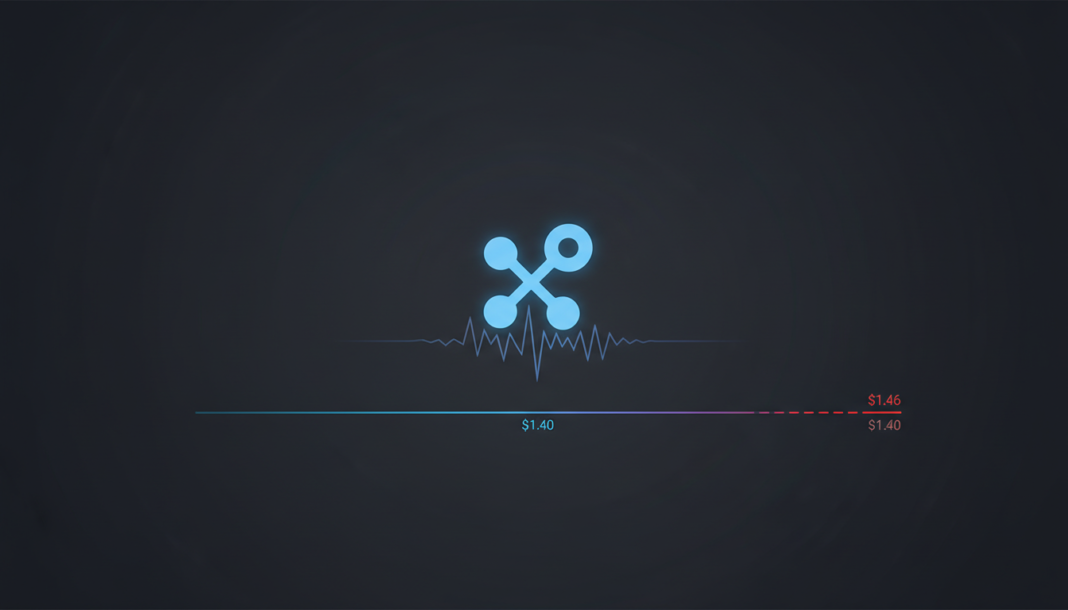

XRP trades near $1.40, struggling below a key technical resistance level of $1.46. While regulatory sentiment may offer speculative upside, price action remains within a corrective trend as momentum indicators like the MACD have yet to confirm a bullish reversal.

XRP is consolidating near $1.40, a critical juncture below its 20-day simple moving average at $1.46. Analysts note that closing above this level is required to invalidate the current lower-high structure and potentially target a move toward $1.60-$1.65.

Failure to reclaim $1.46 could see a continuation of the broader downtrend, with support levels identified at approximately $1.26 and $1.20. The MACD indicator shows an early bullish crossover but remains below the zero line, suggesting downward momentum persists.

Regulatory developments continue to influence market sentiment for the Ripple-associated asset. Brad Garlinghouse has anticipate[d] that U.S. cryptocurrency regulation will take place in early March 2023, though he provided no evidence for this claim.

This ongoing regulatory uncertainty is seen as a factor that could create trading opportunities. Market participants may interpret potential legislative momentum as a reduction in uncertainty, which could increase price volatility around key technical levels.