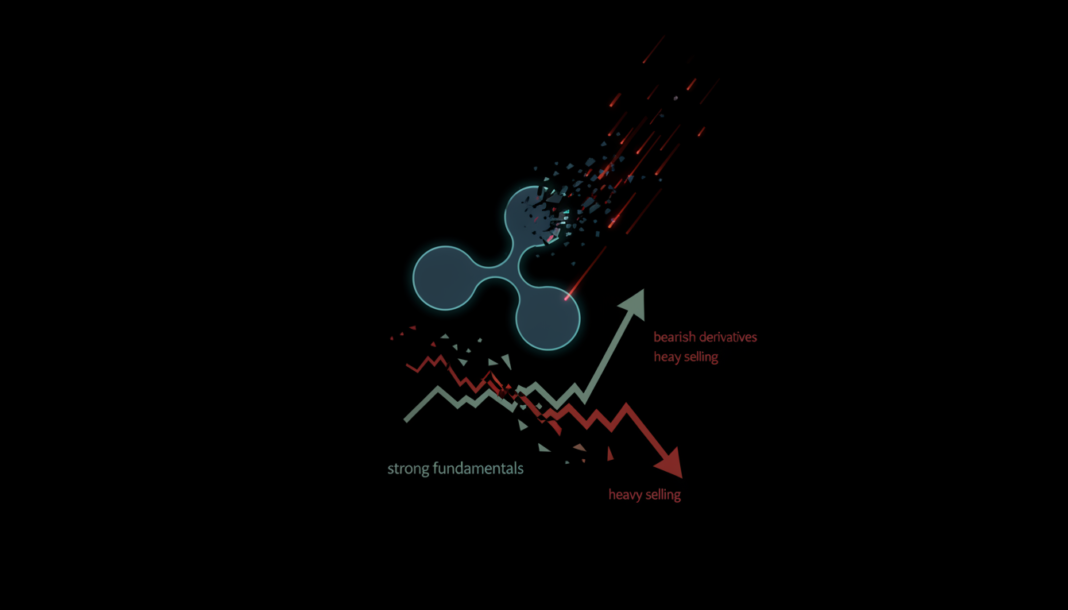

Ripple’s XRP token fell sharply, dropping 9% to trade at $1.50. Despite the price decline, fundamental data shows strength as the total number of XRP holders reached a new all-time high of 507,110. Significant institutional backing also remains, with SBI Holdings maintaining a major stake, but derivatives market activity is driving near-term selling pressure.

The cryptocurrency XRP recorded one of the steepest drawdowns among top assets, dropping 9% in 24 hours. Market sentiment indicated the decline may not be over as momentum slowed.

Fundamentally, XRP’s position remains strong with sustained investor conviction. Long-term holders continue to accumulate despite a 58.9% decline from its all-time high over seven months.

Institutional confidence is also evident, as highlighted by a key executive at SBI Holdings Inc.. The firm’s president reaffirmed in a post that “SBI owns more than 9%” of Ripple Labs.

However, recent price weakness stems largely from derivatives market activity. Short sellers have been aggressive, leading to approximately $13.5 million in liquidations for bullish traders.

Data from CoinGlass shows capital in XRP’s perpetual market dropped by $245.7 million. The Open Interest-Weighted Funding rate fell to 0.0101%, indicating bearish positions dominate.

Chart analysis shows XRP remains confined within a broader descending channel. The token could test a lower demand zone or rally toward a recent wick low of $1.67, depending on momentum.

For now, perpetual trader activity is the dominant factor shaping the short-term trajectory. This occurs even as long-term fundamentals continue to indicate strength from both retail and institutional holders.