XRP has entered a corrective phase following its early 2025 rally, with current trading around $1.38. Technical analysis indicates a bearish trend, with strong resistance seen between $1.75 and $2.00 and key support near $1.00. Analysts note that a break above $2.47 during a potential alt-season could target moves toward $4.80 and higher.

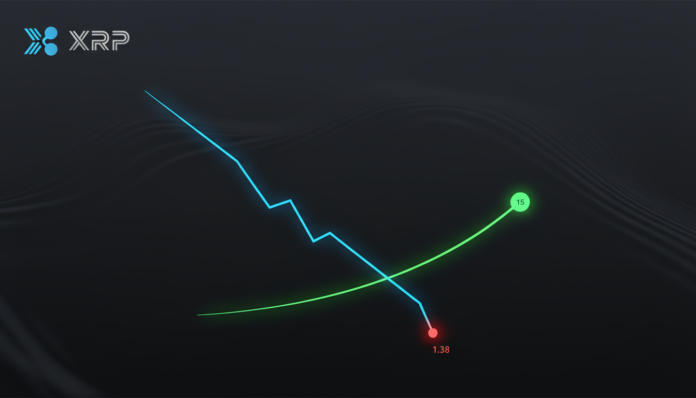

XRP is in a corrective-to-bearish phase after its surge above $2.20 in early 2025, according to a TradingView analysis from February 12. The token is now making lower highs and lows, with its price near $1.38 confirming a bearish weekly structure.

Technical indicators show the Tenkan-sen has crossed below the Kijun-sen, and the Chikou Span is below both the price and the Ichimoku Cloud. This configuration signals seller control, with the cloud itself flattening and turning slightly bearish.

The next major support level is the psychological mark of $1.00, while resistance is anticipated between $1.75 and $2.00. Momentum indicators like the RSI are near oversold territory, which may prompt a short-term bounce, but the MACD remains negative and declining.

Analyst Javon Marks highlighted XRP’s historical performance, noting a previous 600% run. He believes that XRP performs well during the alt-seasons and may even go above $2.47 if the market conditions are favorable.

This scenario could open the door to a target near $4.80, a gain of over 230%. While the weekly chart shows a correction, past performance and potential alt-season trends present possible recovery opportunities for the asset.