XRP trades at $1.62, gaining 1.81% on the day but down 14.29% over the past week. Technical analysts note the asset has entered a key Fibonacci zone, suggesting a potential Wave 4 relief rally if it can reclaim resistance between $1.78 and $2.03. Market indicators show an oversold RSI but continued bearish momentum on the MACD.

XRP is trading at $1.62, according to market data. The token’s daily volume has declined 36.45% to $3.39 billion, following a weekly price drop of 14.29%.

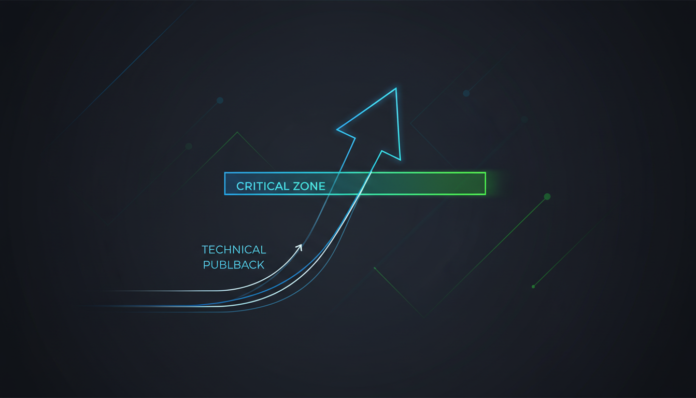

Analyst CasiTrades highlighted that XRP has reached the 0.618 Fibonacci Golden Pocket and a 1.618 Wave 3 extension. “Resistance has been found near the 0.382 retracement level priced at $1.78,” the analyst stated, noting this area is near a previous support level.

The analyst said a reclaim of the $1.78 to $2.03 zone could reduce chances of a bearish move toward $1.55. A bullish divergence was printed at the recent low, but CasiTrades confirmed resistance needs to break for a reliable trend reversal.

Another analyst, CryptoWZRD, mentioned XRP’s daily candle closed in bullish territory. The analyst said the next major resistance could be $2.00, with price above $1.64 sustaining upward pressure.

The daily Relative Strength Index (RSI) is at 29.22, signaling oversold conditions. However, the Moving Average Convergence Divergence (MACD) remains in bearish territory at -0.1029.

Market direction now depends on whether XRP can break above the identified resistance levels. Analysts emphasize watching the price action in the $1.78 to $2.03 range for confirmation.