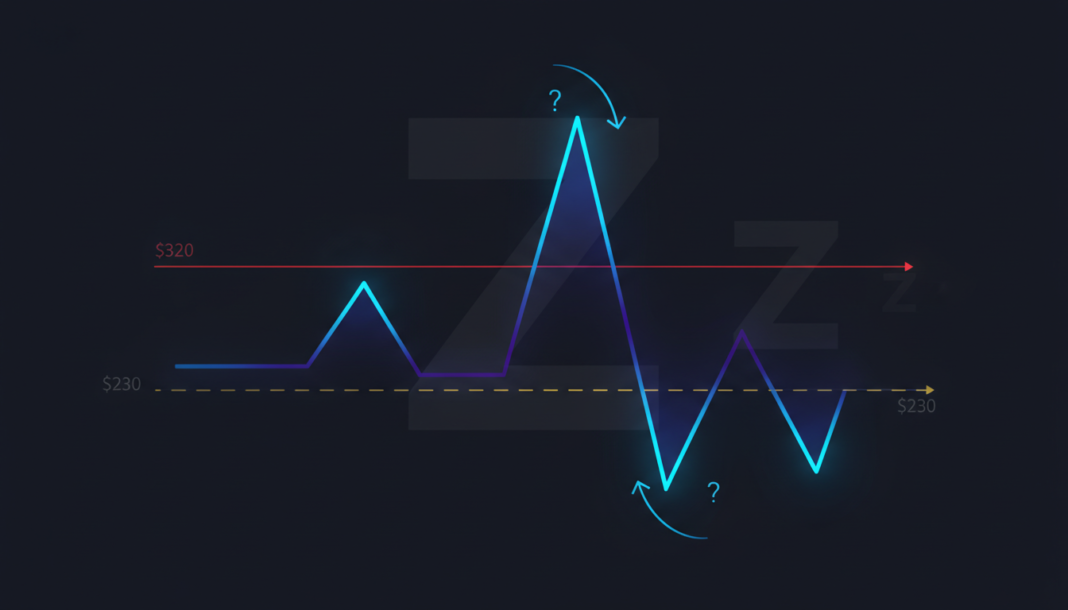

Zcash (ZEC) is testing a crucial resistance level near $320, which analysts identify as a key inflection point for its trend. Momentum indicators show early signs of recovery from recent bearish pressure, but a failure to hold above $320 could see the price retrace toward a $200–$230 consolidation range.

The privacy-focused cryptocurrency Zcash (ZEC) is approaching a critical resistance near $320. According to crypto analyst Ardi, this level serves as the last line for a potential continuation of its current uptrend.

A successful breakout above $320 would require overcoming a descending trendline and the overhead resistance. This two-level confirmation would signal a legitimate long opportunity for traders anticipating upward momentum.

Failure to break and hold above $320 may lead to a retracement. The asset could then return to its previous consolidation range between $200 and $230.

Momentum indicators point to an early recovery phase. The Relative Strength Index (RSI) sits at 43.61, showing a slight improvement from bearish trends but remaining below the neutral 50 level.

The Moving Average Convergence Divergence (MACD) shows a tentative bullish crossover. The MACD line has crossed above the signal line, with the histogram turning slightly positive.

Technical analysis suggests the market is in a delicate position. While indicators show recovery signs, ZEC’s price action at the $320 resistance will likely determine its near-term direction.