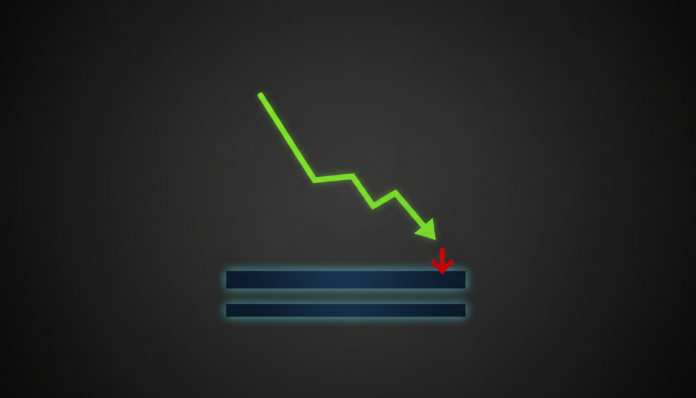

Zcash (ZEC) traded near $245, having broken below the critical $300 support level, which has now turned into resistance. The cryptocurrency faces strong bearish pressure, with its price printing lower highs and lower lows. Sellers are targeting the $240–$244 support zone, and a breakdown below $240 could accelerate losses toward the $200–$210 psychological area.

The privacy-focused cryptocurrency Zcash remained under significant selling pressure as its price formed a consistent pattern of lower highs and lower lows. At press time, ZEC traded near $245 after breaking below the $300 support level, which has now flipped into a key resistance barrier.

Sellers pushed the price toward the $240–$244 support zone, marking the near-term downside target. If this area fails, analysts note downside risk could expand toward the $200–$210 zone where deeper demand may potentially emerge. Resistance for any recovery attempt sits between $260 and $280, with $300 acting as the main structural barrier.

Bears retained control below $300, while a loss of $240 exposed ZEC to a deeper slide toward $200. Recent price action showed the asset completed a sharp capitulation move, declining from around $270 into the $238–$240 demand zone. In that zone, buyers responded firmly, printing a candle that rejected prices below $240.

This rejection shifted short-term order flow as the price stabilized instead of extending losses. Two consecutive green candles then formed a higher low near $244–$246, strengthening early recovery signals. The broader trend, however, remains bearish below the $300 level.

Beyond technical price action, the sector faces headwinds from ongoing regulatory scrutiny. Competition from newer privacy solutions has also continued to weigh on overall market sentiment for assets like ZEC.