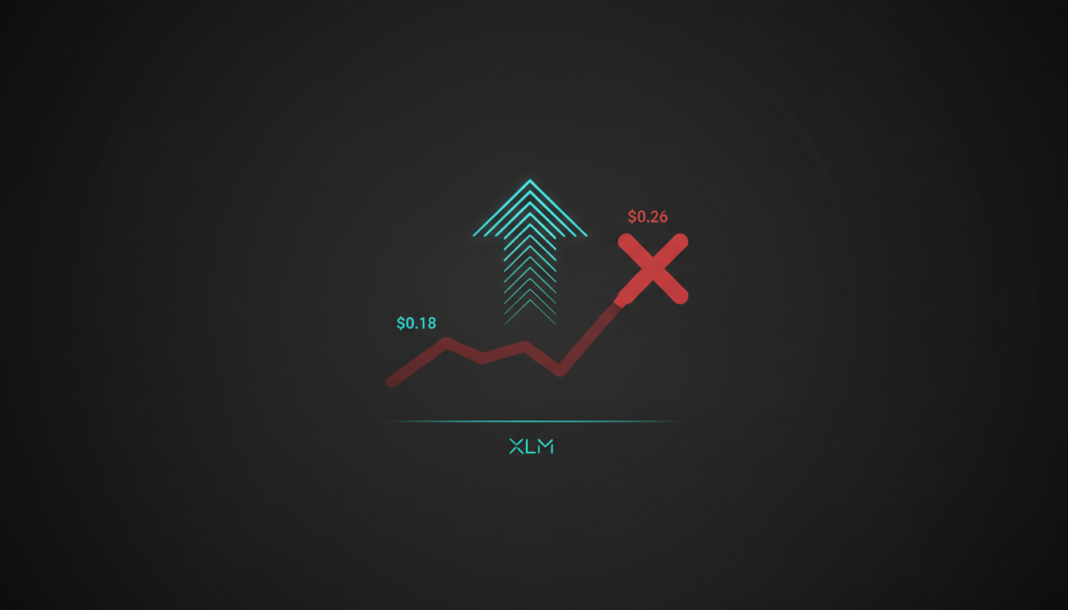

Stellar (XLM) gained nearly 4.8% in 24 hours to trade around $0.18, extending a short-term recovery. The broader weekly trend remains negative, with the token trading below key moving averages and facing strong resistance between $0.22 and $0.26. Analysts note failure to break this resistance could see a drop toward $0.17-$0.14, while a weekly close above $0.26 might open a path to $0.38-$0.40.

Stellar’s native token XLM recorded fresh gains as buyers pushed prices higher. According to CoinMarketCap data, the token rose nearly 4.76% over the past 24 hours, extending its weekly recovery momentum.

The token is trading at $0.18 with a 24-hour trading volume of around $241 million. Market capitalization climbed about 4.6% during the session, though analysts caution the broader weekly trend remains under bearish control.

On the weekly timeframe, XLM continues to move within a prolonged bearish structure formed since mid-2025. Price action remains below major moving averages, reinforcing seller dominance on higher timeframes.

Strong resistance now sits between $0.25 and $0.26, where multiple technical levels converge. Immediate downside targets remain around $0.17, followed by $0.14 if selling pressure returns.

Momentum indicators suggest a slight tick up but favor sellers overall. On the weekly chart, the RSI is hovering around 32.8, below its 36.8 moving average, indicating weak momentum.

The MACD remains in the red, and the line continues to decline below the signal line. The bars on the histogram are decreasing in size, indicating diminishing selling pressure but not yet a bullish crossover.

For those monitoring XLM, resistance levels at $0.22 and $0.26 need to be watched. A failure to break past these levels could see the price drop to levels around $0.17 to $0.14.

A break past the $0.26 level could see the price rise to levels around $0.38 to $0.40. The price movements need to be monitored before entering any new trades.