The Solana-based meme token BONK stabilized near a critical support level on Tuesday, February 3, after holding the lower boundary of a falling wedge pattern. Analysts observed fading bearish momentum, with price action suggesting weakening seller control and growing buyer interest at current levels. Key upside targets are identified at $0.00000860 and $0.00001300, while a drop below $0.00000550 would invalidate the bullish setup.

BONK stabilized near a critical technical support level on Tuesday, February 3. The token held the lower boundary of a falling wedge pattern on the daily chart after breaking out of a broader descending channel.

This signaled fading bearish momentum following weeks of sustained downside pressure. According to crypto analyst Jonathan Carter, the post-breakout structure remains intact as BONK successfully retested wedge support.

The price behavior suggests sellers are losing control while dip buyers are stepping in. If BONK confirms a rebound, the first upside resistance stands near $0.00000860.

A sustained move above this level could shift short-term bias toward $0.00001300. “Additional upward momentum may allow BONK to reach a historical barrier around $0.00001970,” Carter’s analysis noted.

On the downside, the bullish setup remains valid as long as price trades above $0.00000550. Momentum indicators reflect early signs of stabilization according to data from TradingView.

The Relative Strength Index was hovering near 37, rising from an oversold level of 26. The rising RSI indicates that selling pressure is lessening, though momentum remains weak.

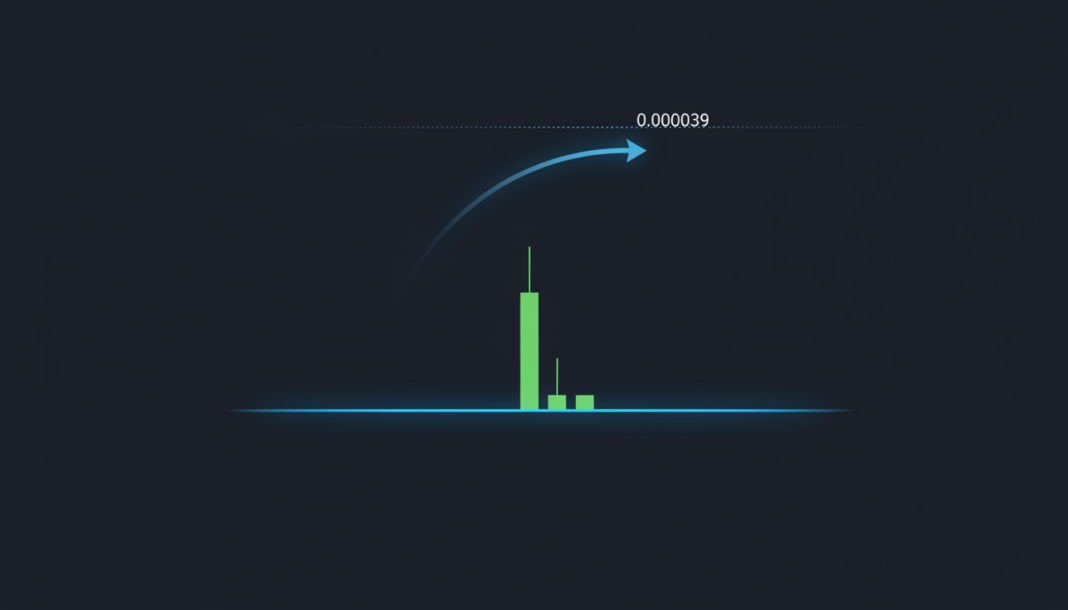

The MACD is in negative territory but shows the histogram bars getting smaller. This pattern suggests the strength of the bearish momentum is decreasing.