The cryptocurrency market’s total value fell to $2.2 trillion, with altcoins like Solana suffering significant declines. SOL plummeted to a two-year low of $67 before a partial recovery to above $80. This volatility triggered over $167 million in long position liquidations in two days, including a single whale losing $6.7 million. Spot buyers emerged at the lows, but derivative traders shifted to short bets as technical indicators suggested sellers remained in control.

The cryptocurrency market extended its decline, with total capitalization falling to $2.2 trillion. Altcoins, particularly Solana [SOL], suffered steep losses.

Solana dropped 15%, breaking below $70 and hitting a two-year low of $67 before rebounding slightly to $81.6. Its market capitalization concurrently fell below $50 billion, indicating substantial capital outflows.

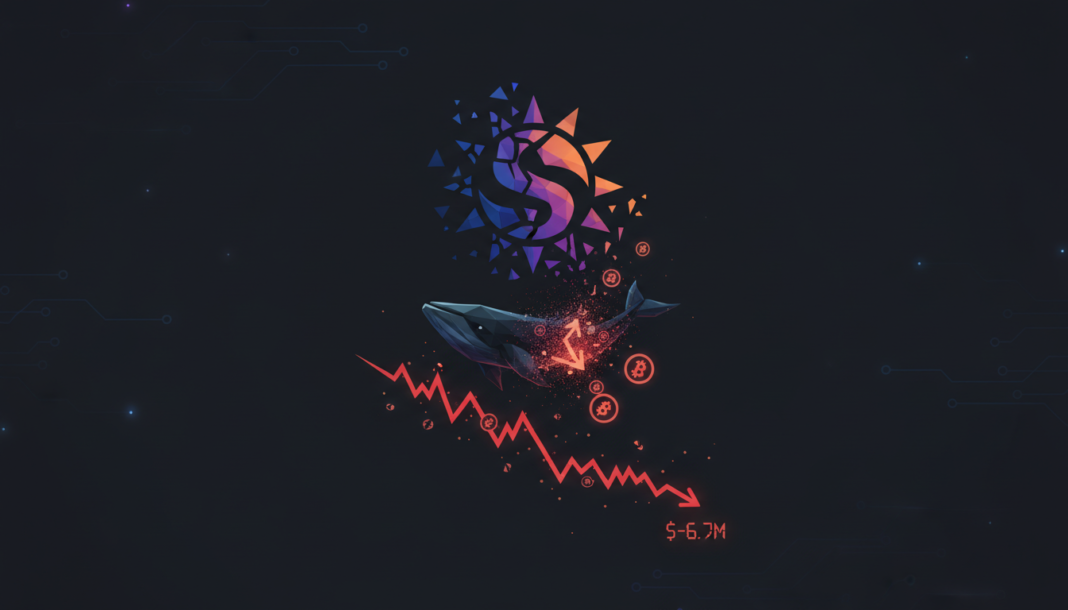

Amid this downside volatility, whale investors in the futures market experienced forced liquidations. According to Onchain Lens, one whale was completely liquidated on its SOL long position, losing $6.7 million.

Overall, the whale lost over $16 million during the current market decline. Significantly, over $167 million in long positions were liquidated between February 5 and 6.

Usually, forced selling exerts immediate selling pressure on the market, further accelerating the asset’s downward momentum. Thus, these liquidations exacerbated market stress, causing Solana to decline further.

In response, investors changed strategy and increased short positions. Data shows the Long Short ratio fell below 1 to 0.96, indicating most traders anticipated further losses.

At the same time, the altcoin jumped back above $80 as investors bought the dip on the spot market. The altcoin’s Netflow dropped to November 2025 levels, falling to -$101 million on February 5.

Notably, over $7 billion worth of SOL flowed out of exchanges, a clear sign of aggressive spot accumulation. Despite this, sellers retained complete control.

The altcoin’s Relative Strength Index (RSI) fell deeper into the oversold zone, dropping to 21. With momentum indicators dropping to such a level, this suggested strong downward momentum.

Equally, it indicated a potential continuation of the prevailing trend. Therefore, if these conditions persist, SOL could drop again below $70.