Ripple’s XRP experienced heightened market volatility, breaking structural support and triggering defensive derivatives positioning. The price fell from around $3.00 in late September toward the $2.00 zone as funding rates turned deeply negative. A subsequent recovery was fueled by significant whale accumulation and robust growth in XRP ETF assets under management, which reached $1 billion in under four weeks.

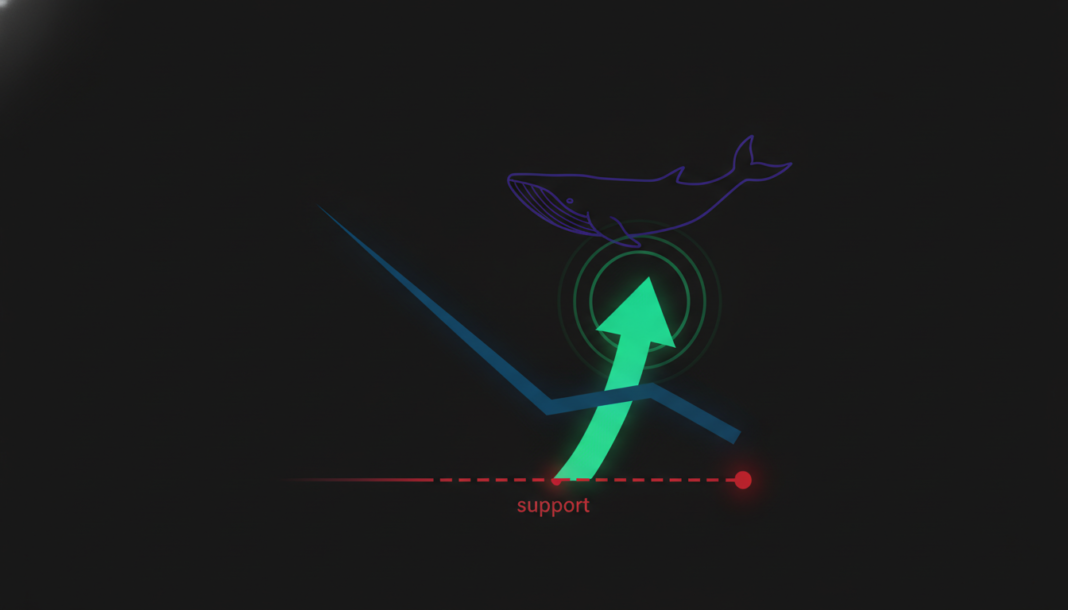

Retail panic intensified as Ripple [XRP] broke below structural support. The OI-Weighted Funding Rate turned negative, signaling rising short exposure as traders hedged downside risk.

Price fell from the $3.00 region toward the $2.00 demand zone as funding dropped past -0.05%. Liquidation risk compounded the move as positioning grew increasingly one-sided.

As prices stabilized, on-chain data began confirming strategic accumulation. XRP rebounded over 25% from sub-$1.15 lows to reclaim the $1.50 zone.

Whale participation accelerated, with 1,389 transactions above $100,000, marking a four-month high. Network engagement expanded simultaneously, as 78,727 active addresses printed within an eight-hour window, a six-month peak.

Beyond the rebound, structural adoption catalysts reinforced the sentiment. Messari’s Q4 2025 report positioned the XRP Ledger within an expansion phase supported by institutional access and rising utility.

The launch of XRP ETFs in November marked a key milestone, with products amassing $1 billion in AUM in under four weeks. Stablecoin growth added further liquidity depth, with RLUSD market cap rising 164% quarter-over-quarter to $235 million.

Tokenization activity followed, with RWA market cap climbing 37% QoQ to $281 million. Average daily transactions increased 3.1% QoQ to 1.83 million, signaling sustained utilization.

Positioning dynamics now define XRP’s forward trajectory. If exchange reserves continue declining while whale balances expand, the rebound may evolve into a structural trend reversal.

However, if Open Interest rises faster than spot demand while funding overheats, the move may reflect leverage-driven momentum. In that case, resistance near prior supply zones could cap upside and reintroduce volatility.