Forward Industries holds nearly 7 million Solana tokens despite over $1 billion in paper losses. The debt-free, Nasdaq-listed company is leveraging its position to expand its treasury strategy while other crypto-focused firms face financial strain due to the market downturn.

Forward Industries stated this week that it continues to hold nearly 7 million Solana (SOL) tokens despite mounting unrealized losses caused by the recent crypto market downturn. The company remains the largest publicly traded corporate holder of SOL.

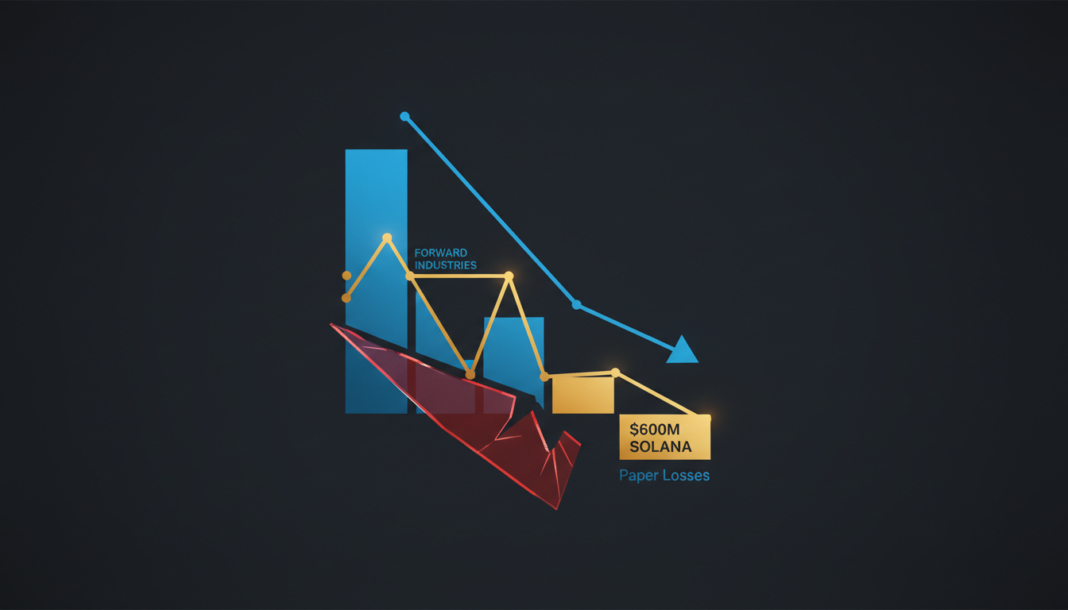

Solana is currently trading between $85 and $88, making the stake worth close to $600 million. The average acquisition cost was approximately $232 per token, translating to nearly $1 billion in paper losses for the firm.

Recent market weakness has caused several crypto-focused treasury firms to sell assets or restructure liabilities. Forward Industries, however, has no corporate debt, allowing it to pursue acquisitions while others cut exposure.

The firm reoriented its operations in 2025 after raising about $1.65 billion in financing backed by Galaxy Digital, Jump Crypto, and Multicoin Capital. This capital supports its strategy of hoarding and expanding treasuries on the Solana network.

Management deploys these SOL assets to generate estimated annual yields of 6% to 7%. A partnership with Sanctum facilitated the fwdSOL rollout, keeping assets liquid to produce staking rewards.

Leadership describes Forward as a permanent capital vehicle focused on backing tokenized assets with durable cash flows. They argue Solana’s speed and lower costs make it attractive for consumer applications and financial services.

Industry observers believe consolidation among crypto treasuries will continue to accelerate. Analysts have noted that volatility remains a major risk to these corporate holdings.

The regulatory framework for corporate crypto assets is also evolving in the US and European Union. This adds another layer of complexity to treasury operations for public companies.