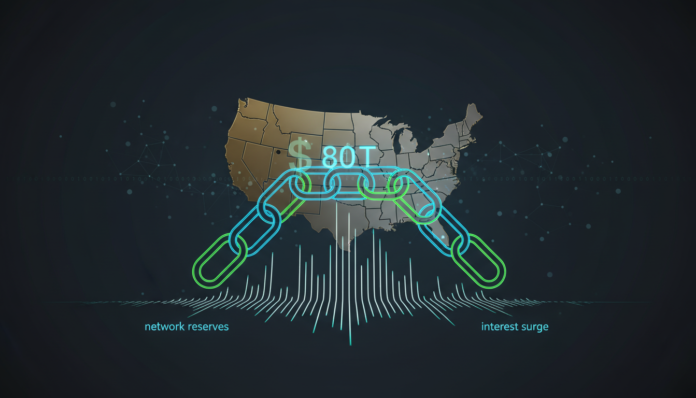

Chainlink has expanded its blockchain infrastructure by introducing real-time U.S. stock and ETF prices on-chain, a move the firm claims unlocks $80 trillion in equities for decentralized finance. This development bolsters Chainlink’s role as a primary data layer for on-chain financial products, occurring alongside significant network activity including a major increase in LINK reserves, a rise in Open Interest to $233 million, and steady growth in the number of holders.

The Chainlink network has taken a major step by introducing real-time U.S. stock and ETF prices on-chain. A recent update from the firm claims this development unlocks $80 trillion worth of assets in equities for decentralized finance.

This connection between traditional markets and blockchain technology positions Chainlink as the primary data layer for on-chain financial product support. The development enables DeFi projects to rely on live equity prices through Chainlink’s oracle solution.

Concurrently, the network’s reserve balance gained 88,845.86 LINK in 24 hours, with total holdings reaching 1,675,112.67 LINK. Historically, such movements highlight active treasury management during periods of growing network adoption.

In derivatives markets, LINK’s Open Interest climbed to $233 million at the time of writing. The hike in Open Interest levels highlights growing capital mobilization as traders ramp up activity.

The number of LINK holders has continued to rise steadily, standing at 177,000. This holder count surge mirrors broader participation during periods when adoption narratives gain visibility.

The expansion into real-time equity pricing coincides with the hike in reserve balances and derivatives interest. These factors collectively highlight the growing relevance of Chainlink’s network in the tokenized finance industry.