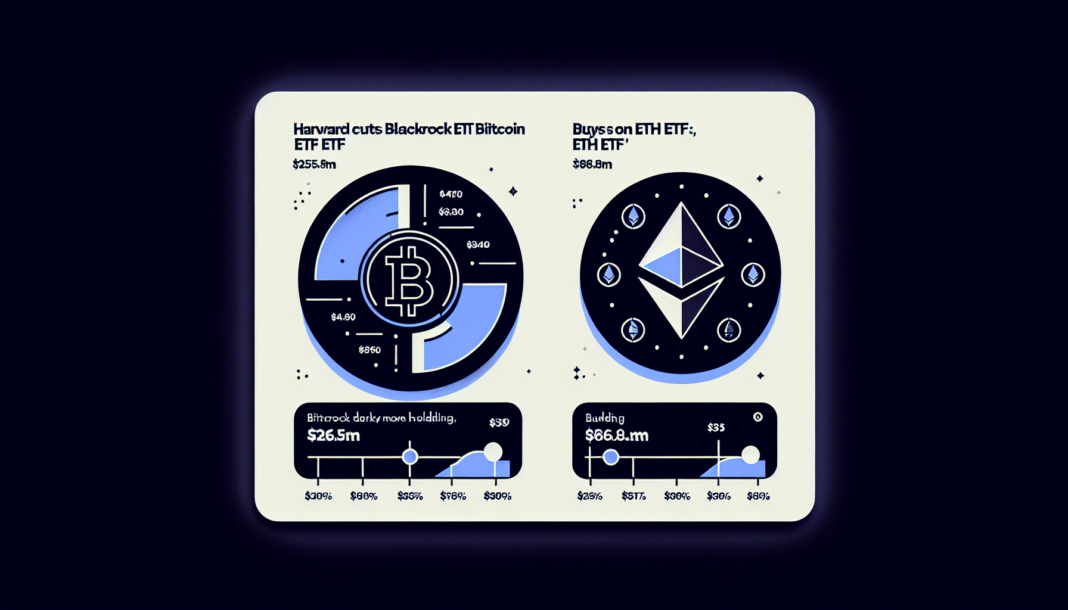

According to filings, Harvard Management Company cut its stake in BlackRock‘s Bitcoin ETF (IBIT) and opened a new position in BlackRock‘s Ethereum ETF. The filings show the moves as a reallocation of the endowment’s digital-asset exposure.

It trimmed IBIT holdings from about $443 million to roughly $266 million. It also added about $87 million to BlackRock‘s Ethereum ETF.

The change came during a volatile market phase after October’s largest single-day crypto liquidation event. The market has not fully recovered losses from that correction.

ETFs now act as a key price driver and a primary institutional access point for crypto. Many investors view Ethereum as having more upside potential.

They cite $30,000 for ETH as about a 15x rise. They note BTC reaching $1 million would be roughly a 14x increase.

Both ETFs remain meaningful holdings in the portfolio and illustrate crypto’s growing integration into mainstream institutional allocations.