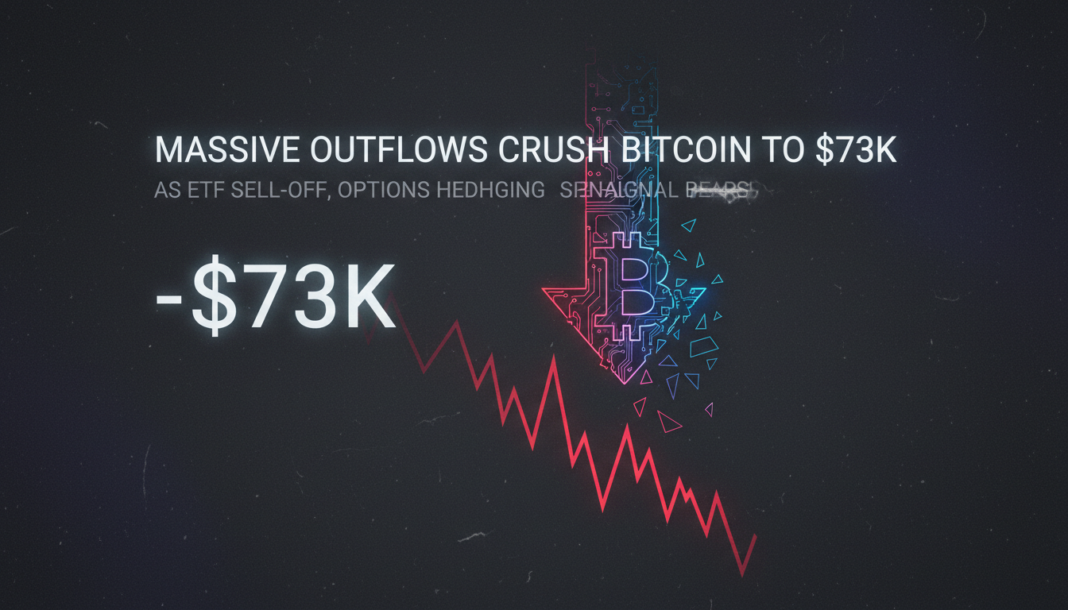

Bitcoin faces significant selling pressure, dropping below $73,000 amid sustained outflows from U.S. spot ETFs and large-scale liquidations. Professional traders, as shown by options market data, are hedging against further declines, reflecting concerns linked to a broader tech stock sell-off and lingering market impacts from a major 2025 exchange incident.

Bitcoin fell below $73,000 on Wednesday after briefly touching $79,500 a day earlier. This mirrored a decline in the tech-heavy Nasdaq, driven by weak sales outlooks from companies like AMD and disappointing U.S. employment data. Traders are concerned about ongoing price pressure as spot exchange-traded funds recorded over $2.9 billion in outflows across 12 trading days.

The average daily net outflow of nearly $243 million from U.S.-listed Bitcoin ETFs since January 16 followed Bitcoin’s rejection near $98,000. This 26% correction triggered $3.25 billion in liquidations for leveraged long futures positions. Some market participants linked recent instability to the aftermath of a $19 billion liquidation event on Binance in October 2025, which was reportedly triggered by a technical glitch.

According to Haseeb Qureshi, managing partner at Dragonfly, huge liquidations at Binance “could not get filled, but liquidation engines keep firing regardless.” Qureshi added that the October 2025 crash did not permanently “break the market,” but noted that market makers “will need time to recover.” His analysis suggests cryptocurrency exchange liquidation mechanisms focus on minimizing insolvency risk rather than market stabilization.

BTC options metrics reveal professional traders doubt the recent $72,100 low is a definitive bottom. The options delta skew reached 13%, indicating strong demand for downside protection amid fears of a tech sector downturn. Further market discomfort stems from unfounded rumors, including one about a Galaxy Digital customer’s sale, which the firm’s head of research denied on social media.

Another speculation involves Binance‘s solvency, which gained traction after the exchange faced new technical issues. However, onchain metrics suggest Bitcoin deposits at the exchange remain relatively stable. Given the macroeconomic uncertainty, many traders have opted to exit cryptocurrency markets, making it difficult to predict if ETF outflows will continue to pressure Bitcoin’s price.