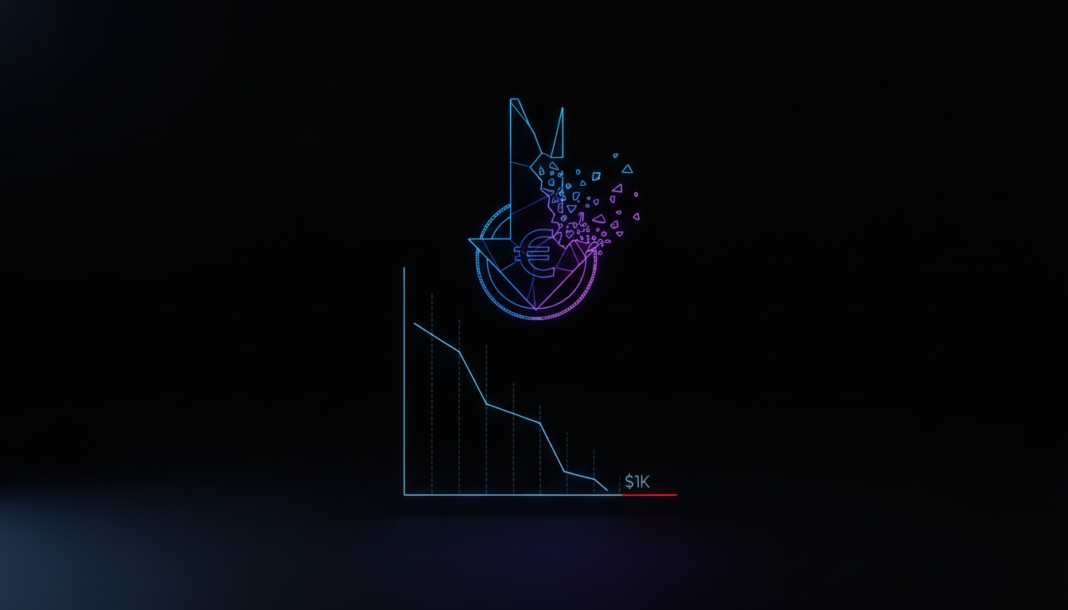

Ethereum traded near $1,975 in late February 2026, down roughly 60% from its high the prior October. Prediction markets on platforms like Kalshi reflected significant bearish sentiment, assigning a nearly 50% chance of ETH falling to $1,250. However, technical analysis showed a key bullish pennant formation remained intact above the $1,513 support level.

Ethereum continued trading near $1,975 after collapsing nearly 60% from its October 2025 peak. Tension intensified across markets as Kalshi’s contracts reflected growing conviction in further downside.

Traders priced roughly a 49–50% probability of Ethereum dropping to $1,250 by 2026. Nearly 30% odds extended toward levels below $1,000, with the bearish framing centered on ETF outflows and institutional selling pressure. Historically, extreme downside probabilities often emerged near emotional exhaustion, leading some participants to view this as defensive overcrowding.

Despite this, Ethereum’s higher timeframe structure remained technically intact. A bullish pennant formation continued to compress price action, with $1,513-$1,537 acting as immediate structural support.

Liquidation heatmaps showed most downside liquidity had already been cleared. Substantial liquidity remained positioned above ETH’s price, with clusters extending toward the $5,000 region on higher timeframes.

The market entered a decisive confrontation phase between bearish sentiment and persistent structural integrity. As progress into 2026 continues, psychology remains split between fear-dominated positioning and the technical outcome controlled by structure.