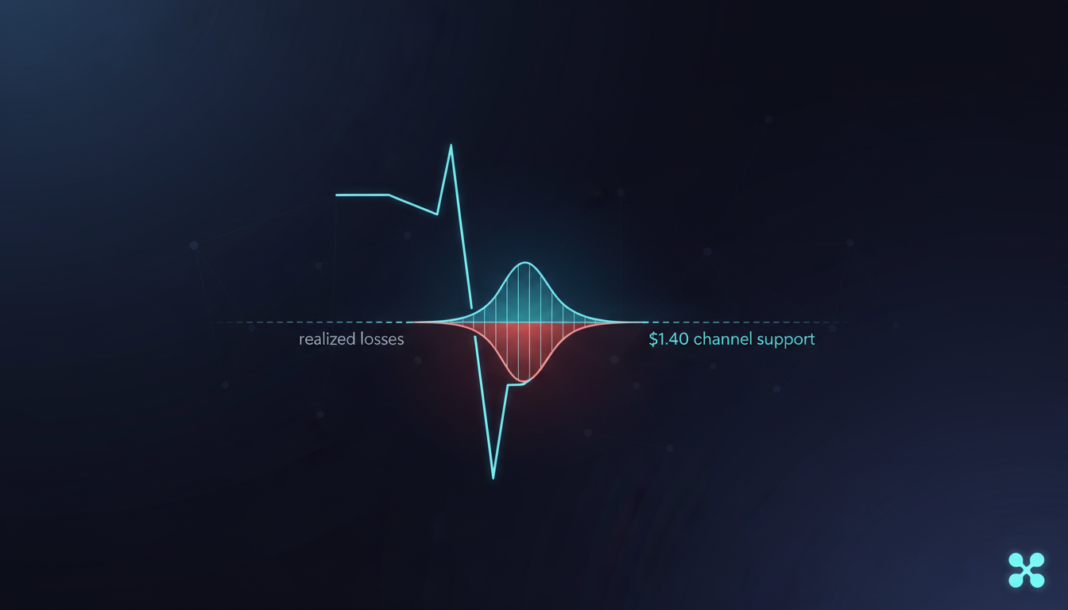

XRP is navigating a critical juncture as its price tests long-term channel support between $1.20 and $1.40. The asset recently printed its largest spike in realized losses since 2022, an event historically clustered near market exhaustion points. Meanwhile, the Network Value to Transactions (NVT) Ratio spiked 108% as on-chain activity lagged, and Binance traders maintain heavily long positioning, creating a tense environment for the cryptocurrency’s next major move.

XRP’s price continues to trade inside a prolonged descending channel, now defending a key support region between $1.20 and $1.40. Attempts to reach $1.79 or $2.20 have failed, but price compression near the lower trendline shows reduced downside momentum.

The MACD indicator shows a bullish convergence, suggesting weakening selling pressure. However, data from CryptoQuant reveals a sharp 108% rise in the NVT Ratio to 454.51. This signals market value is expanding relative to lagging network transaction throughput.

On derivatives markets, Binance top trader positioning shows 68.91% of accounts hold long exposure, with a Long/Short Ratio of 2.22. This reflects strong directional conviction despite the current price weakness and elevated NVT reading.

The convergence of heavy realized losses, channel compression, and crowded long positioning defines a pivotal zone for XRP. A sustained hold above $1.20 support alongside continued MACD expansion could enable a recovery attempt. However, a breakdown would likely trigger rapid liquidations of leveraged long positions.