Uniswap’s UNI token fell to a two-year low of $4.11 amid a broad market crash before a slight rebound. A long-dormant whale sold 2.49 million UNI for $10.62 million after five years, and on-chain data indicated a significant spike in exchange inflows, signaling heightened selling pressure. Technical indicators showed the token in deeply oversold territory, raising questions about its near-term support level.

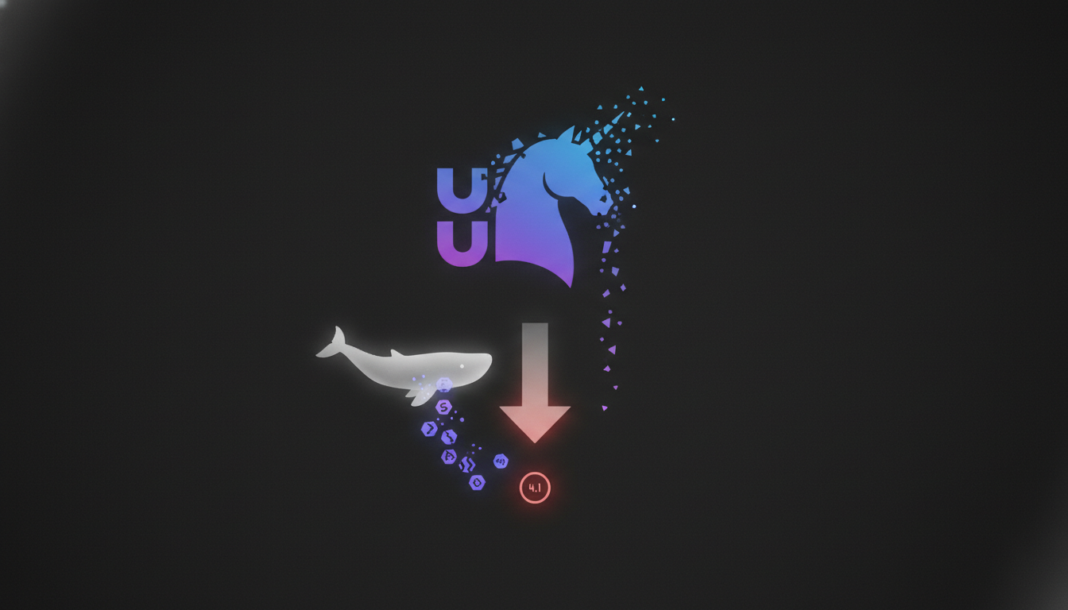

The Uniswap governance token UNI recently plunged to a two-year low near $4.11. It subsequently staged a modest recovery to trade at $4.15, reflecting increased market volatility across cryptocurrencies.

A significant whale holding was liquidated during the downturn, according to Arkham data. This entity, dormant for five years, sold 2.49 million UNI for approximately $10.62 million, realizing a profit of $1.72 million.

On-chain metrics showed a substantial sell-off by other participants on January 30. CryptoQuant data recorded an exchange inflow surge to a two-month high of 4.2 million UNI, with outflows at 1.7 million.

Concurrently, the Exchange Supply Ratio climbed to a two-month high of 0.09. This suggested increased token distribution on trading platforms, which historically can accelerate downward price pressure.

Technical indicators reflected severe selling momentum. The Relative Strength Index dropped to 27, while the Relative Vigor Index fell to -0.12 after a bearish crossover.

“Often, such market conditions signal downside risk and the potential for its continuation,” the analysis noted. The prevailing conditions suggest sellers currently dominate the market for UNI.

The combined pressure raises the risk of the token breaching the $4 support level. However, a reversal could occur if investors begin buying at what some may perceive as a discount.